The 50, 25, 0 Trifecta

China's response to Covid, Russia's invasion of Ukraine, persistently high inflation, and the banker’s response to said inflation continue to drive the broader investment climate. Three G7 central banks are front and centre in the week ahead – the US Federal Reserve's will announce its policy rate on Wednesday, the Bank of England on Thursday, and the Bank of Japan on Friday.

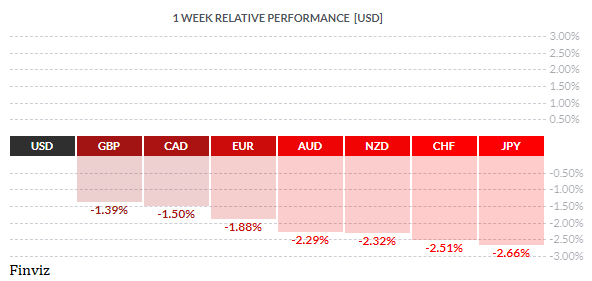

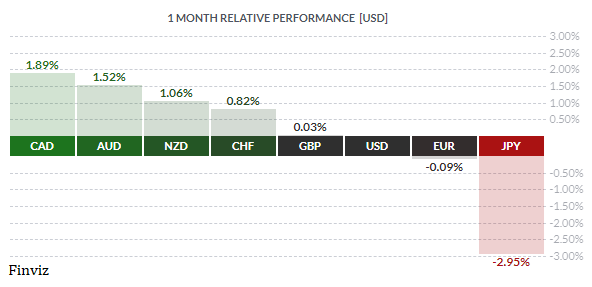

In our last letter The USD Wrecking Ball, which was out a month ago, I put out the daily chart of the USD/CAD and showed that it was in the process of topping out. The USD had topped out at about 1.3050 and fell all the way to 1.25200 early last week. It has since pop over 1.28 and finished last week around 1.2760. That was pretty well the case for the other commodity currencies, the NZD and the AUD, as can be seen by the chart of the monthly performance below. Notice that the GBP and Euro made very little progress as Europe is bogged down with the war and high energy costs while the UK with politics at home, high energy costs, and a slowing economy. As for the yen, more on that later.

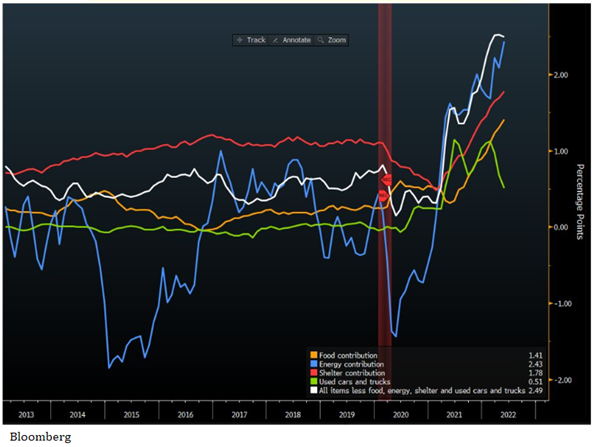

The USD started to firm up as it approached Friday’s US CPI release. It registered 8.6% y/y vs an expectation of 8.3% y/y. This is the highest reading since December 1981. After the lower than expected reading in April (8.3% y/y vs 8.5% y/y expected) many were hoping that the peak in inflation was behind us. But it was not meant to be. The chart below shows that price pressures are broadening – energy (blue) and core services (white) are rising the most; shelter (red) and food (gold) and rising steadily; while used cars (green) has peaked.

And with that high inflation reading, the possibility of a Fed pause in September went out the window. The reason the USD came down over the last month was that Fed watchers interpreted the notion of assessing the impact of rate hikes “later in year” (from the last Fed minutes and from a couple of Fed policymakers) as a pause in rate hikes in September.

The Fed will announce its policy decision this Wednesday which will include forecasts for interest rates (dot plot), inflation and growth. After their last meeting, the market was expecting 50 bps hike in June, July, and September and 25 bps hike in November, December, and February 2023. After Friday’s hot inflation reading the market is now pricing in four consecutive 50 bps hikes. There is also a 50% possibility that the Fed hikes by 75 bps on Wednesday. The March dot plots showed the median dot was for the Fed funds range to be 1.75%-2.0% at the end of the year. The market’s view is closer to 3.15%. It will be interesting to see if the new dot plots match up with the market’s revised view.

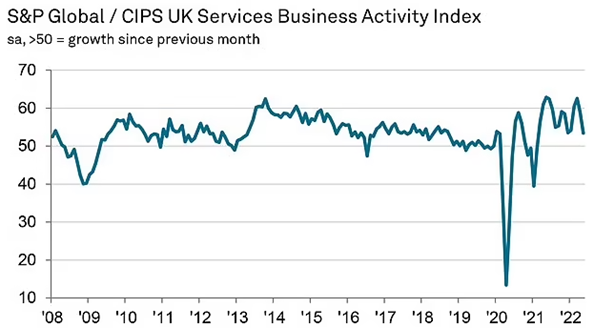

Meanwhile, the Bank of England is only expected to raise rates by 25 bps on Thursday. I said only because they are facing an even higher rate of inflation than the US, which is expected to hike by 50 bps. The UK’s inflation rate for April jumped to 9.0% from 7.0%. More increases in inflation are likely in the months ahead, in fact, the BOE expects it to average a little over 10% at its peak in Q4 2022. The main reason that the BOE is not being as aggressive as the Fed is that the UK economy is slowing much more than the US. The S&P Global/CIPS UK Services Purchasing Managers' Index fell to 53.4 in May from 58.9 which caused S&P Global to point out that “the monthly loss of momentum for business activity expansion was a survey record outside of lockdown periods.” This has all the markings of a stagflationary environment.

Lastly, the Bank of Japan will hold its policy meeting on Friday and is expected to leave rates unchanged at -0.1%. Last week, the European Central Bank pre-committed to a 25 bps at their July meeting and said that it will hike again at the September meeting. That will leave the BOJ as the outlier in central banking circles as it will continue to defy global monetary policy trends and keep its policy loose. This alone explains why yen has fallen to 20-year lows against the USD. To be fair, the inflation rate in Japan just poked above 2% and BOJ Governor Kuroda has been adamant that the driving factors (like the base effect from last year's cut in the cell phone charges and higher energy prices) are not sustainable.

The bottom line is that the higher inflation goes, the further behind central banks fall behind the curve, so they have to step up or lose credibility which raises the odds of a policy error (hiking right into a recession). With this in mind, all eyes and ears will be on each central bank’s forward guidance for any clues as to their future interest rate paths.

.

|

by Tony Valente Senior FX Dealer, Global Treasury Solutions |

|||

Would you like to receive all of our blog posts directly to your inbox? Click here to subscribe!