USD Rebirth?

The USD index has finally been able to establish as short-term bottom, as it has put together its first 4-week sequential advance since early February. Back then, the USD was being buoyed by the promises of repeal/replace Obamacare and tax policy reform. The USD’s hopes were dashed when it became obvious that the Republican Party did not hold uniform views, coupled with the stubbornly underwhelming inflation landscape. Meanwhile, growth in the rest of the global economy continued to strengthen.

The USD index has finally been able to establish as short-term bottom, as it has put together its first 4-week sequential advance since early February. Back then, the USD was being buoyed by the promises of repeal/replace Obamacare and tax policy reform. The USD’s hopes were dashed when it became obvious that the Republican Party did not hold uniform views, coupled with the stubbornly underwhelming inflation landscape. Meanwhile, growth in the rest of the global economy continued to strengthen.

Yet in the last few weeks the USD has been able to find its legs. A lot of the latest USD euphoria is based on the perception that Mr. Market has become increasingly confident that some elements of President Trump’s proposed tax reform will be achievable in the months ahead. Furthermore, last week we saw a resurgence in US economic data – PMI, auto sales, and factory orders all surprised to the upside. Yes, the labour report was bad with a loss of 33K jobs but that was to be expected considering the magnitude of the damage inflicted by the two hurricanes.

Has the USD turned the tide? According to the technicals, that remains to be seen, let’s see how it handles the blue downtrend line in the weeks ahead. As for the fundamentals, the US economy has been basically stuck around 2% annual GDP. Three factors worth considering the prospect of a USD rebirth rest with monetary policy, tax reform and the prospect of a change at the Fed Chair.

Mr. Market is convinced that the Fed will hike rates one more time this year. However, he remains sceptical of the Fed’s plans to raise rates three times in 2018.

Will a tax reform bill stir the next leg up in the USD? The experience of trying to repeal/replace Obamacare earlier in the year, doesn’t really inspire much confidence. We have a sneaking suspicion that, if a tax reform bill passes, it most certainly won’t be revenue neutral - it will widen the budget deficit significantly. Given that the US is one of the few highly indebted countries making no progress on reducing its debt-to-GDP ratio, this development would not be USD positive.

President Trump’s choice for the Fed chair, along with three other vacancies on the Fed board, needs to be clarified before the USD can make any headway. Last Wednesday, the USD was briefly rattled by news that aides to President Trump had offered a list of candidates for the Fed chair and although Janet Yellen was in it, they withheld her recommendation. The slate of candidates were dovish (apparently more dovish than Yellen) which the market took as the President’s attempt to unduly influence the direction of monetary policy. An easy Fed would support a weak dollar policy.

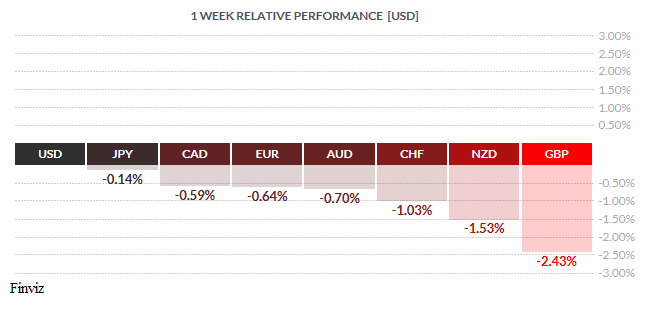

It wasn’t all about the US last week – Catalonia voted to separate from Spain, the GBP tumbled, while the CAD continued to stumble. A lot of ink has been spilled about the possible separation of Catalonia from Spain and the options Spain has to control this. With history as our guide, the likelihood of this transpiring is so remote that the euro took it in stride. We say this because Catalonia is not the only region in the EU demanding more autonomy or independence – there are at least seven others; Scotland from Britain, Flanders from Belgium, Basques from Spain, New Caledonia from France, Faroe Islands from Denmark, and Lombardy and Vento from Italy. The EU will not let these regions use the euro has their currency so they would need to issue their own domestic scrip – faced with this they would not be able to separate from their respective countries. After having stumbled, the euro was able to recover over the 1.17 level. The fact that the euro has only been mildly fazed by the Spanish situation tells us that the USD index will be hard pressed to move higher considering the euro makes up the currency basket’s largest weighting at 57.6%.

The GBP was the worst performing currency last week, down 2.43%, and at one point losing 4 big handles on the rate falling from just over the 1.34 level to the low 1.30 level. The weakness was surprising given that there is little change in expectations for a Bank of England rate hike. Most pundits believe that the rate hike will go ahead and that the BOE will be simply taking back the post-Brexit rate cut and not the start of a mini-tightening cycle.

The trouble for currency lays with politics – more specifically, the confidence in Prime Minister May. May attempted to put forward her vision of the “British Dream” but it was overshadowed by a prankster handing her a P45 (a British form for termination of employment), an incessant cough, and problems with the backdrop. Notwithstanding the distractions, the speech proposed two main themes of opposition parties - boosting social housing spending and capping household energy bills. This caused her party and the media to question how long the PM can carry on. In reality, no one in the party really wants to replace her as the PM because it would be political suicide, since they would be responsible for delivering a Brexit deal, which would almost certainly be unpopular. Thus, the reasoning is to let May carry on and take the fall after delivering the deal.

The CAD dollar did manage to recover on Friday after being down every day last week. The CAD bounced up from a five-week low after Friday’s solid domestic employment report. After losing 88k full-time jobs in August, the Canadian economy gained 112k in September and the pace of wage growth was the fastest in more than a year reducing worries that the economy could slow down in Q4. The message earlier in the week was that the Bank of Canada was expecting some softness going forward but the jobs report didn’t confirm that. While the BOC will stand pat at this month’s policy meeting, Mr. Market still sees a 65% chance of a rate hike in December.

Key Data Releases This Week

| Forecast | Previous | |||

| MONDAY, OCTOBER 9 | ||||

| TUESDAY, OCTOBER 10 | ||||

| 04:30 | GBP | Manufacturing Production m/m | 0.2% | 0.4% |

| WEDNESDAY, OCTOBER 11 | ||||

| 14:00 | USD | FOMC Meeting Minutes | ||

| THURSDAY, OCTOBER 12 | ||||

| 08:30 | USD | PPI m/m | 0.4% | 0.2% |

| 08:30 | USD | Unemployment Claims | 255K | 260K |

| 10:30 | EUR | ECB President Draghi Speaks | ||

| 11:00 | USD | Crude Oil Inventories | -6.0M | |

| FRIDAY, OCTOBER 13 | ||||

| 08:30 | USD | CPI m/m | 0.6% | 0.4% |

| 08:30 | USD | Core CPI m/m | 0.2% | 0.2% |

| 08:30 | USD | Core Retail Sales m/m | 0.9% | 0.2% |

| 08:30 | USD | Retail Sales m/m | 1.5% | -0.2% |

|

by TONY VALENTE Senior FX Dealer, Global Treasury Solutions |