Two Views, The Fed & The Market

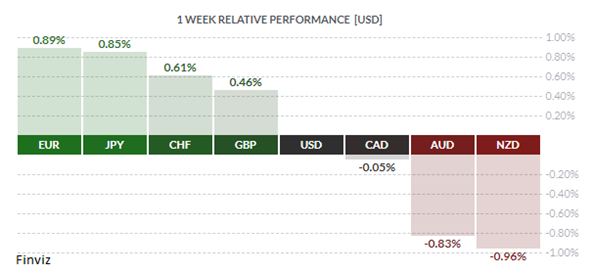

Since I last put pen to paper, a banking crisis flared up which saw three banks go under. The three banks were Silvergate, Signature, and Silicon Valley. In order to put a stop to a bank run, the Federal Reserve, Treasury, and FDIC invoked a clause that allowed making uninsured depositors whole. For now, this backstop has worked. Having said that, the bank run may have spread overseas as the Swiss government and central bank sprang into action to save Credit Suisse by arranging a sale to UBS. Meanwhile, on Friday, we heard that the contagion may have spread to Germany’s Deutsche Bank. We will learn more this week.

This banking episode can play out in two ways. The central bank, government, and banking authorities are successful in stopping the contagion and slowly, everything goes back to normal. Or bank deposits flee to larger banks as fear takes over. The smaller banks tap the Fed’s facility to get access to capital to stay solvent. Either way, all banks will probably rein in lending going forward. If this latter scenario happens then that long waited recession, which everyone is expecting, happens sooner rather than later.

Against this backdrop, the Fed had a tricky decision to make at last week’s FOMC meeting. Raise rates by 25 bps to maintain its inflation-fighting credibility but not 50 bps in the middle of the banking crisis. If they decided to not raise it at all perhaps that would fuel the crisis even more by creating the impression that the crisis is worse than it is. Either way, the optics of once again bailing out the financial sector while tightening the screws on Main Street are not good.

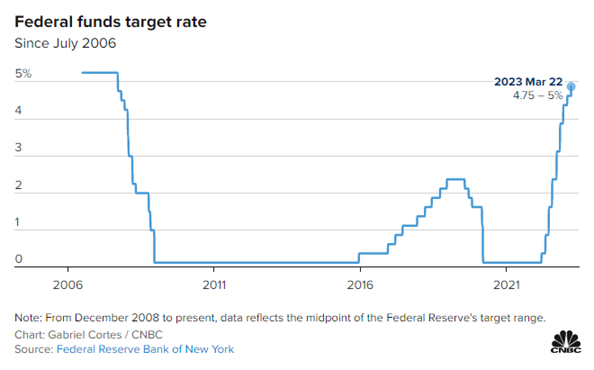

Well, as you probably already heard, the Fed stayed the course and hiked by 25 bps bringing the Fed funds rate to a range of 4.75% - 5%, the highest since 2007. Despite the Fed slowing its roll, Chairman Jerome Powell has repeatedly said inflation remains a top priority - “Restoring price stability is essential to set the stage for achieving maximum employment and stable prices over the longer run.”

More importantly, the FOMC noted that future increases are not assured and will depend largely on incoming data. “The Committee will closely monitor incoming information and assess the implications for monetary policy,” the FOMC’s post-meeting statement said. “The Committee anticipates that some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time”. Notice the change in wording from previous statements which indicated “ongoing increases” would be appropriate to bring down inflation.

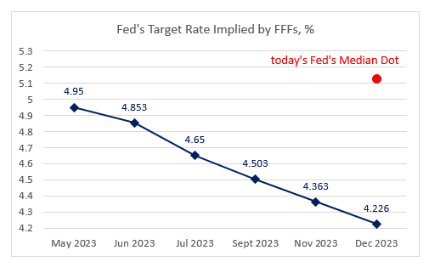

In the presser after the policy announcement, Powell ended the presser with this mic drop “rate cuts are not in our base case” for the remainder of 2023.

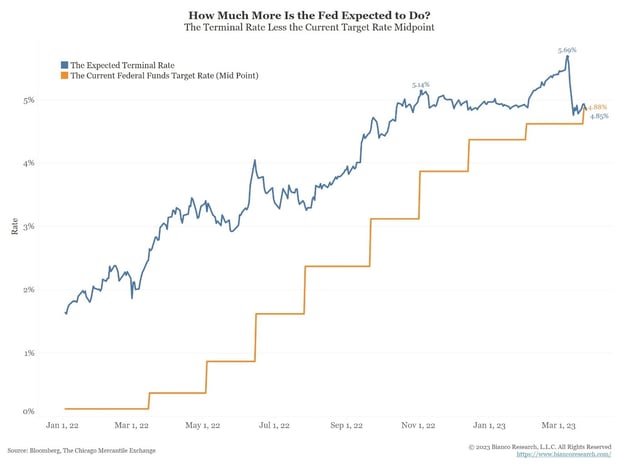

Despite what the Fed did and said the market saw and heard something else. The market has determined that this was the Fed’s last hike – a dovish hike. The Fed is done.

The probability of a hike at the May meeting has slumped to 12%, the lowest it has been in months. At the June meeting, the probability of a rate cut is now 46.2%.

So as you can see, the market doesn’t see the Fed’s view. According to the Fed, they haven’t finished hiking rates just yet and that rate cuts are not in the cards this year. What’s the old saying – the Fed hikes until something breaks? Does this banking crisis qualify as the thing that broke?

|

by Tony Valente Senior FX Dealer, Global Treasury Solutions |

|||

Would you like to receive all of our blog posts directly to your inbox? Click here to subscribe!