Transfixed and On Edge

Markets have been transfixed by inflation, monetary policy, and geopolitics.

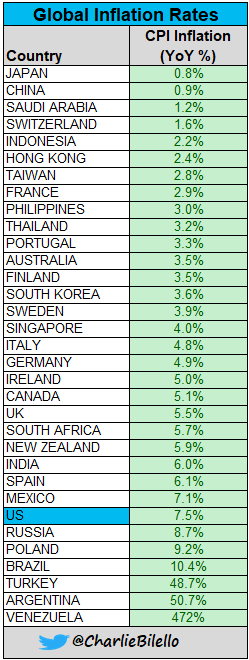

January inflation in the US rose by 0.6% and now stands at 7.5%, not yet banana republic territory as you can see in the chart below. It was the biggest annual increase in inflation in 40 years. In Canada, inflation surpassed 5% for the first time since September 1991, rising 5.1% on a year-over-year basis and up from a 4.8% gain in December 2021.

Soaring inflation rates plays right into monetary policy. Interest rate hikes are warranted. Even though the Bank of Canada didn’t hike at its last meeting, the Governor, Tiff Macklem (probably the coolest name heading a central bank) did sound a hawkish tone. He warned that the policy rate may have to go over the neutral rate (2.25%) in order to address the price pressures. As a side note, my first mortgage in 1989 was for 11.2%, really it was. If Tiff thinks 2.25% is the neutral rate that only tells me that the world is so much more in debt, then back in 1989.

From the negative rate central banks, the European Central Bank has finally found religion. It turns out that a sizable minority wanted to change policy at the February 3rd meeting. The ECB finally acknowledged mounting inflation risks and even cracked the door open to an interest rate increase this year. This is rather a remarkable policy turnaround for one of the world’s most dovish central banks.

From the negative rate central banks, the European Central Bank has finally found religion. It turns out that a sizable minority wanted to change policy at the February 3rd meeting. The ECB finally acknowledged mounting inflation risks and even cracked the door open to an interest rate increase this year. This is rather a remarkable policy turnaround for one of the world’s most dovish central banks.

In the US, St. Louis Fed President James Bullard caused a stir in the market a couple of weeks ago when he said that he favored a 50 bps hike at its upcoming meeting in March, and wanted a total of 100 bps rate hikes by July. However, last Wednesday’s release of the minutes of the previous FOMC meeting showed that most members were not on the same page as Bullard. The minutes showed a conservative approach, wanting to remain as data dependent as possible and avoid pre-committing to any specific policy changes. Highlights from the minutes are below:

- A FEW PARTICIPANTS NOTED THAT ASSET VALUATIONS WERE ELEVATED ACROSS RANGE OF MARKETS, RAISING CONCERN THAT MAJOR REALIGNMENT COULD CONTRIBUTE TO FUTURE DOWNTURN

- PARTICIPANTS ANTICIPATED THAT IT WOULD SOON BE APPROPRIATE TO RAISE THE TARGET RANGE FOR RATES

- SIGNIFICANT BALANCE SHEET CUT LIKELY APPROPRIATE

- MOST PARTICIPANTS PREFERRED TO BRING ASSET PURCHASES TO AN END IN EARLY MARCH

- A COUPLE OF PARTICIPANTS FAVORED ENDING ASSET PURCHASES SOONER TO SEND AN EVEN STRONGER SIGNAL THAT THE COMMITTEE WAS COMMITTED TO BRINGING DOWN INFLATION

We may have reached the peak “aggressive tightening” narrative as the minutes show that Fed officials are willing to accelerate the pace of tightening, they are not quite ready to follow Bullard’s aggressive call for a 100 bp hike in the next three meetings and an aggressive unwind of the balance sheet. The Fed funds futures market is roughly split between 75 and 100 bp here in the first half of the year. The odds of a 50 bp hike next month has fallen from about 80% on February 10th to a little less than 35%, the lowest in two weeks.

Moving on to the geopolitics. You can hate Russia all you want but you need to understand their position in order to make the right decisions with your money. Russia believes that the West broke its promise at the end of the cold war in 1989-1990 that NATO would not expand to the east. NATO can’t accept a new member whose borders are disputed. Thus, by threatening the Ukraine border, Russia is able to keep Ukraine out of NATO. This isn’t any different then the Cuban Missel Crisis of 1962, when the Soviet Union installed nuclear-armed missiles in Cuba, just 90 miles from US shores. The Crisis was finally avoided when the Soviets agreed to remove the missiles in exchange for the removal of US missiles from Turkey. Let us hope for a similar peaceful outcome.

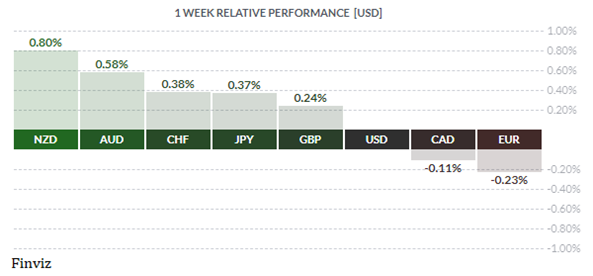

The markets are on edge, and they are now moving in a “risk on” “risk off” manner with each US/Russia headline. US Secretary of State Anthony Blinken will be meeting with his Russian counterpart, Sergey Lavrov, later in the week, so be on guard for volatility for each passing headline. In risk off mode, gold, the USD, Yen, and Swiss franc are the places to be. During risk on, all the other currencies will tend rally against the USD.

|

by Tony Valente Senior FX Dealer, Global Treasury Solutions |

|||

Would you like to receive all of our blog posts directly to your inbox? Click here to subscribe!