Q1 Review

It was a pretty subdued mode in the forex market last week due to the holiday shortened week and lack of any economic data surprises. Thus, other than the month-end and quarter-end flows it was a pretty quiet week of trading. In fact, the biggest mover on the week was the Japanese yen as it fell almost 1.5% against the USD on the week. The fall was the largest single-session decline since January of 2017 and was caused by news that North Korean leader Kim Jong Un, visited Chinese President Xi Jinping, where he declared that Pyongyang was committed to denuclearizing and starting a dialogue with the US. Since the yen is considered somewhat of a barometer for risk, it’s not surprising the yen sold off on this “feel good news”.

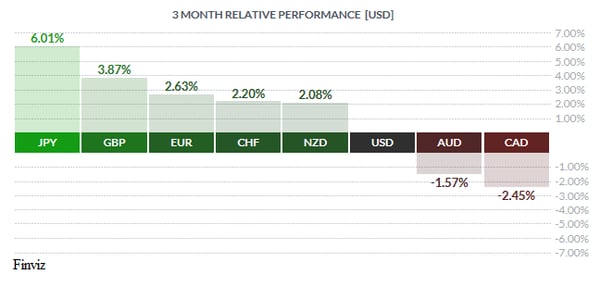

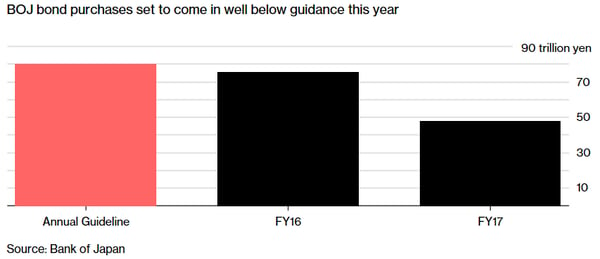

Despite last week’s sell-off, the Yen was the top performing currency in Q1. The Bank of Japan unintentionally triggered a rally in the yen on January 9 when it unexpectedly cut purchases of long term bonds, fanning speculation that the reduction signaled its ultra-loose policy could end sooner than expected. The “stealth taper” has led to a 6% rally against the USD despite repeated remarks from BOJ Governor Haruhiko Kuroda that the BOJ will keep policy accommodative. The BOJ’s yield curve targeting is meant to keep 10-year bond yields around zero percent, which has caused it to buy less government bonds, hence the stealth taper. Fast forward to now, trade tensions triggered by the Trump administration and uncertainty over the stock market’s outlook are weighing on bond yields, which are only adding to the BOJ’s headaches as it requires them to buy fewer bonds.

The GBP was the second best performing currency in Q1 and has been in a steady uptrend after the hammering in took in 2016 over the Brexit vote. Q1 economic data has been very positive and has increased the odds that the Bank of England will be able to deliver two rate hikes this year. This point was reinforced by two policy members who voted against keeping rates on hold at the most recent MPC meeting, calling for an immediate hike.

The first quarter story for the euro has been mostly quiet – like watching paint dry, especially for the last two months of the quarter. As you can see in the chart below, it has been trading broadly sideways in a defined range. As we see it, there are only two themes that can cause the euro break higher out of that range – a taper announcement from the ECB or a renewed downtrend in the USD.

The worst performing currencies in Q1 belong to Australia and Canada. The reasons for their poor showings are very similar. Both economies have cooled off from Q4 of last year and both countries are facing trade issues. For Australia, President Trump’s tariffs of $60 bn on Chinese products have hit the AUD hard since the Australian economy has high exposure to the China trade story. For Canada, trade uncertainty in the form of renegotiating NAFTA has caused the CAD to shed almost 2.5% against the USD. Having said this, the CAD has been able to buck it recent downtrend, over the last couple of weeks, due to the US’ apparent willingness to soften its contentious proposal on automotive rules of origin in NAFTA talks. The price action in the CAD has carved out a potential head and shoulders formation which, if activated, could see the CAD head back up to the 80 cent level.

What have we learned from Q1 regarding the US. For starters, GDP for the first quarter is looking like it will come in around the 2% mark. Atlanta Fed’s GDP now indicator has it at 2.4%, NY Fed’s Nowcasting indicator has it 2.7%, and some investments houses have it even lower around the 1.6%. This tells us that US tax cuts may not boost the economy as fast as they boost federal deficits. Add in a simmering trade war, and you get a recipe for another leg down in the USD. The way we see it, we are one Presidential tweet away from the next disaster, which will send the US dollar index towards the next target at the 85 level. Or, the market will focus on the Fed’s interest rate path and monetary divergence advantage and bid the dollar back up to the 95 level. Let’s see what Q2 has in store for us.

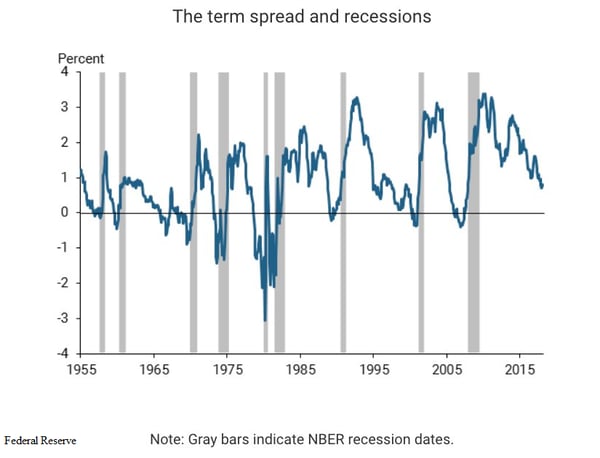

Before we let you go, we would be remiss if we didn’t alert you to this - a key recession signal is back at levels last seen during the financial crisis. The signal in question is the spread between 2-year/10-year which measures the difference between short- and long-term bond yields. This spread fell to 47 basis points last week, the narrowest spread since October 2007. When the spread narrows like this it is referred to as a flattening of the yield curve and the closer it gets to zero the higher the risk of a recession. When the spread goes negative – short-term yields are trading higher than long-term yields – this is known as yield curve inversion. As you can see from this graph below, an inverted yield curve has preceded every recession in the past 60 years.

Key Data Releases This Week

| Forecast | Previous | |||

| MONDAY, APRIL 2 | ||||

| 10:00 | USD | ISM Manufacturing PMI | 60.1 | 60.8 |

| TUESDAY, APRIL 3 | ||||

| 12:30 | AUD | RBA Rate Statement | ||

| 04:30 | GDP | Manufacturing PMI | 54.8 | 55.2 |

| 21:30 | AUD | Retail Sales m/m | 0.3% | 0.1% |

| WEDNESDAY, APRIL 4 | ||||

| 04.:30 | GBP | Construction PMI | 51.2 | 51.4 |

| 08:15 | USD | ADP Non-Farm Employment Change | 206K | 235K |

| 10:00 | USD | ISM Non- Manufacturing PMI | 59.2 | 59.5 |

| 10:30 | USD | Crude Oil Inventories | 1.6M | |

| 21:30 | USD | Trade Balance | 0.72B | 1.06B |

| THURSDAY, 5 | ||||

| 04:30 | GBP | Service PMI | 54.2 | 54.5 |

| 08:30 | CAD | Trade Balance | -2.1B | -1.9B |

| FRIDAY, APRIL 6 | ||||

| 08:30 | CAD | Employment Change | 20.3K | 15.4K |

| CAD | Unemployment Rate | 5.8% | 5.8% | |

| USD | Average Hourly Earnings m/m | 0.3% | 0.1% | |

| USD | Non-Farm Employment Change | 190K | 313K | |

| USD | Unemployment Rate | 4.0% | 4.1% | |

| 11:15 | GBP | BOE Gov Carney Speak | ||

| 13:30 | USD | Fed Chair Powel Speaks | ||

|

by TONY VALENTE Senior FX Dealer, Global Treasury Solutions |