Pause or Hike

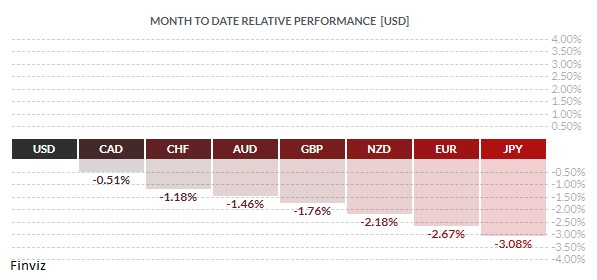

The USD dropped from early March to mid-April due to the mini regional banking crisis. With a strong advance in the month of May, it was able to recapture about 70% of its losses. The recovery in the USD was spurred by monetary policy concerns, continued hawkish comments by Fed members, and fiscal policy drama, safe haven flows into the USD due to the debt ceiling strife.

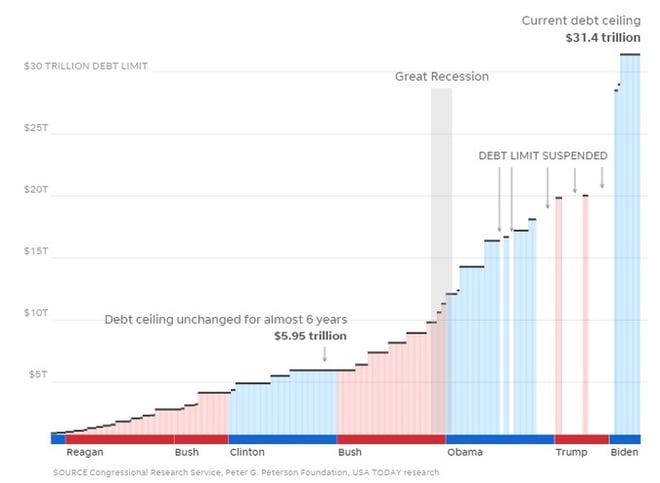

Let’s start with the debt ceiling debacle. Not raising the debt limit would require $1.5 trillion in spending cuts this year. The debt ceiling has been raised 100 times since 1941 (56 times during Republican administrations and 44 times during Democratic administrations). In other words, we have seen this movie before. In fact, they may as well call it a debt floor since every time the limit gets raised it becomes the new floor. Each political party is incentivized to take the crisis to the brink in order to convince their electorate that they secured the best possible deal. It really is a political game of chicken so I wouldn’t expect a deal until the 11th hour.

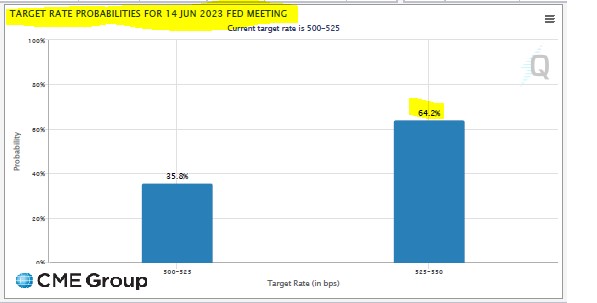

Now for the monetary policy side. Whether it is a pause or hike at the June FOMC meeting, one thing is clear – we are at the tail end of the interest rate adjustment. The Fed began raising rates in March 2022 and at its last meeting in May, Chairman Jerome Powell suggested that a pause was in the cards. However, since that meeting the trifecta of stronger economic data, sticky inflation, and some hawkish comments by Fed members has since the odds of a hike trickle up for the June 13-14 meeting (64.2).

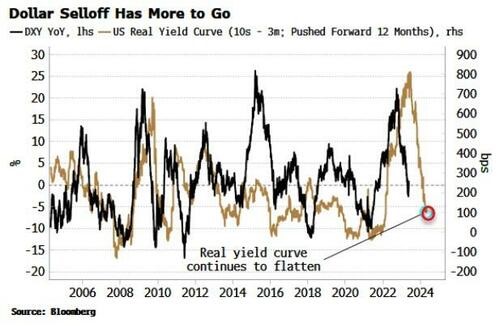

Once the debt ceiling and the June FOMC meeting are behind us the US dollar index may resume its downward trend. One of the best leading indicators for the USD is the real yield curve. In October 2022, this indicator gave us a strong sign that the USD was about to peak. Today, the real yield curve continues to trend lower suggesting that the USD will follow it.

Meanwhile, the euro may be bottoming here. On the same day (May 19th) Chairman Powell was making the cause for a pause, ECB President Christine Lagarde was making hawkish remarks. "It's a time when we have to really buckle up and look at this target that we have and deliver on it. We will take all the measures in order to bring inflation back to 2%. We will do it, no question about it." She made it very clear that a pause was not on the table for the ECB. Money markets assign around a 90% probability of a quarter-point hike in June and fully price such an increase by July before seeing the deposit rate peaking at just below 3.70%. On the daily chart, the euro’s first line of support can be found around 1.0680. A break there may encourage a move back to the March low near 1.0500.

The Japanese yen is down about 3% this month and is now back to where it was in November. However, the economy is much stronger now and well above expectations, in fact the government recently upgraded its monthly economic assessment for the first time in ten months. And then there is the building inflation pressure - the 10-year break-even rate, a gauge of price expectations derived from inflation-linked government notes, climbed to 0.94% this week, the highest since late December. The weakness of the yen only adds to the inflation pressure. Thus, investors are gradually coming to the view that the current inflationary pressure may not be temporary but may be sustained. Remember, the Bank of Japan is the only remaining central bank with a negative policy rate and with the backdrop of building inflation pressure this policy stance can’t last. A change in policy is expected by Q3 which would cause a turnaround in the yen.

The best performing currency against the USD in May has been the CAD. The monthly range has been between 1.3320 to about 1.3650, which is within the year-to-date range of 1.3220 to about 1.38. The CAD has been weighed down by the interest rate differential, the 5% slide in crude oil, and negative risk sentiment in equities. Stronger than expected April CPI helped spur a shift in market expectations for Bank of Canada policy - the market was pricing in a cut before the end of the year and now it is fully discounting a hike by the end of Q3. The Bank of Canada meets on June 6. There is room for some more USD upside, CAD downside, until the debt ceiling is resolved.

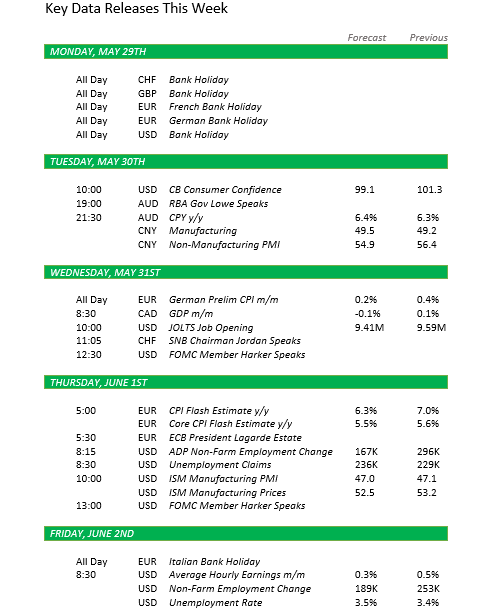

The week ahead is a short one due to Memorial Day holiday but will be a busy one. Board Consumer Confidence for May, OLTS Job Openings for April, Fed's Beige Book, ADP Employment Change for May, Initial Claims, Continuing Claims, Non-Farm Payroll, S&P Global US Manufacturing PMI for May, ISM Manufacturing data, a bevy of Federal Reserve speakers, and the political soap opera known as the debt floor debacle.

|

by Tony Valente Senior FX Dealer, Global Treasury Solutions |

|||

Would you like to receive all of our blog posts directly to your inbox? Click here to subscribe!