|

October Headwinds

As we enter the last quarter of the year, King dollar is still flexing its muscles as it outperformed the rest of the majors except the NZD, more on that later. The dollar is so strong right now that it seems like Japanese officials keep threatening to intervene every other day, to no avail. The September FOMC meeting offered up a pause in its rate hiking campaign, but the USD held firm as the Fed offered up a hawkish Summary of Economic Projections (Fed dot plot) and revised its growth forecasts for this year and next. Among emerging market countries, only Brazil and Chile, have begun cutting interest rates. Elsewhere, no G10 central bank appears close to cutting rates. Having said that, the end of the rate hiking cycle seems close at hand as the terminal rate (optimal policy rate) has been reached or is a quarter point hike away. The only exception in the G10 may be the UK. The month of October may prove to be a turning point for the USD. The USD index has rallied for 11 straight weeks, the longest streak since 2014. As I stated last month, the market has clearly bought into the Fed’s higher-for-longer mantra, for now.

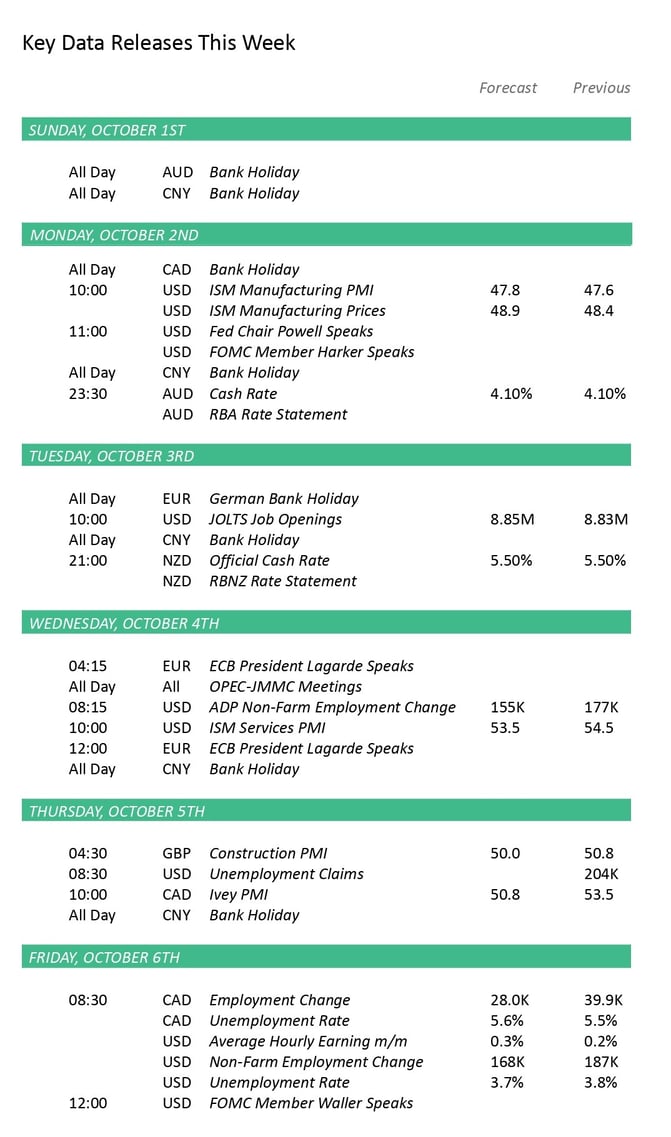

I stress the “for now” comment because the month ahead has many headwinds. Let me list them to show what I mean – higher oil prices, an expanding autoworkers strike, partial government shutdown, banks are tightening lending requirements, tightness in the labor market is easing, and the 3 years holiday of not paying student debt is over and payment will restart this month. Most of these will most certainly curtail consumption, which already looks to be slowing. Interestingly, the government shutdown will partially blind the Fed because it will shelve economic reports that are released by various government bodies. Thus, it is safe to assume that USD strength may start to moderate due to the slowing of the US economy. Let us look at some other currencies to see if they can make some headway against the USD. The Canadian economy hit a ruff spot in Q2, but it was able to recover in Q3 which helped the CAD move from 1.3860 to 1.31 in mid-July. When the Bank of Canada paused in the summer and the Fed keep hiking this allowed the USD to climb to around 1.3700. The CAD was able to recapture those loss as the BOC restarted its hiking campaign. However, a disappointing inflation and GDP report last month have push out a possible BOC rate hike in Q4. The BOC meets on October 17 and will have the luxury of seeing the inflation report before its decision, as well as this week’s job report and IVY manufacturing report. The USD may very well retest its recent highs against the CAD ahead of that decision.

The euro has been in a slump since mid-July when it peaked at 1.1276. The euro’s decline comes down to divergence. The US economy has been resilient while the Eurozone economy is not growing at all. While the US economy gets an added boost from fiscal spending, that is non-existent in Europe and in fact, it will get worse as the Eurozone will re-introduce their budget conscious Stability and Growth Pact fiscal targets which were suspended for Covid and the Ukraine war. At its last ECB meeting, the bank reduced its growth forecast to 0.7% from 0.9% and next year to 1.0% from 1.5%. It also adjusted its inflation forecast to 5.6% from 5.4% for this year and 3.2% from and 3.0% for 2024. Europe really needs inflation to come down but that may prove to be elusive considering the recent run up in energy prices.

Since the euro accounts for slightly above 50% of the USD index it shouldn’t not be surprising that it to is on a 11-week streak, it is just the opposite of the USD, unfortunately. The euro is extremely oversold and has tried to right itself over the last 3 days. If these low holds, then an oversold bounce can easily carry it to the 1.07 level. For the euro to move above this level then it will need generate its own good news instead of USD bad news. The GBP was the weakest currency last month with a drop of 3.71% against the USD. Having said that, just like the euro, the GBP made a stand over the 3 days to stabilize the situation. The Bank of England chose not to hike rates last month which only added to the currencies woes. Like the ECB, the BOE was also forced to downgrade its growth forecast for Q3 to 0.1% from 0.4%. The swaps market has about an 70% chance of a hike before the end of the year.

If a temporary low is not in, then the next downside target would be the 1.20 level. If the low holds, then it will need to clear the overhead resistance at 1.2375-1.2400 to improve its outlook. What can I say about the Yen except, same old story. It is the only central bank that still has a negative policy rate (-0.10%). It also continues to expand its balance sheet while other major central banks are moving in the other direction. Even though they have increased the rate on their yield control policy, the yen continues to decline and that will be the case until they hike rates.

To summarize, the USD may begin to moderate now. However, hotter-than-expected inflation and stronger-than-forecast spending would support the Fed’s more hawkish stance and could add fuel to the USD’s rise.

|

|

by Tony Valente Senior FX Dealer, Global Treasury Solutions |

|||

Would you like to receive all of our blog posts directly to your inbox? Click here to subscribe!