Memo from the Fed: CHILL

FinViz

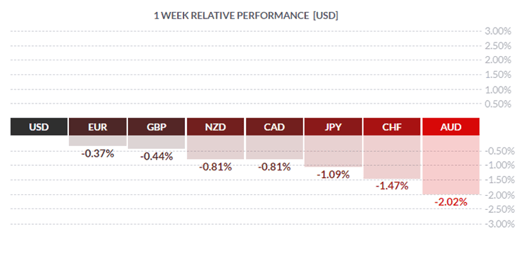

No question, February 2021 was quite the month. On the one hand, the DJIA set a new record high of 31,613.02 in mid-February while Bitcoin soared to an all-time high of 58,330.05 USD before falling back on profit-taking. On the other hand, the bellwether US 10 yr treasury traded to just shy of 1.60% yield following a massive sell-off in the debt markets. The unloved CAD hit its highest level in three years, trading through the 80 cent US level. And in an apparent massive RISK-OFF move by traders and investors, the USD was the clear winner on the week. So, let’s jump in and sort this all out, shall we?

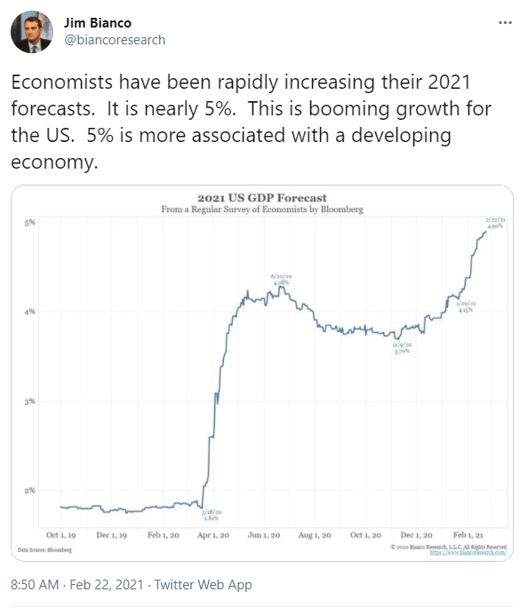

At the beginning of the week, players were all abuzz about rising growth prospects for the US economy and Fed chair Jerome Powell’s upcoming testimony to Congress.

What is unusual is the Fed’s insistence that rates will stay lower for longer, and that the Fed will err on the side of higher inflation rather than lower growth. Moreover, in testimony to the Senate banking committee on Tuesday, Fed chair Jay Powell made the following statement:

“The economy is a long way from our employment and inflation goals, and it is likely to take some time for substantial further progress to be achieved.”

That is a rather clear statement of intent. In other words, even if the economy recovers strongly, and even if inflation starts to rise, the Fed will…stand pat.

Mr. Powell also dismissed concerns of a sudden sharp rise in inflation. Many analysts point to the stimulus package forthcoming from Washington and the success in vaccinating the citizenry against the CV-19 virus as evidence that stronger growth (stronger than anticipated by the Fed) may be a reality sooner rather than later. Mr. Powell also reiterated the Fed’s current QE policy of bond purchases totaling 120.0 bil monthly. (This latter point was a surprise, meaning that even as the economy improves, the Fed will continue buying bonds in an attempt to keep yields down).

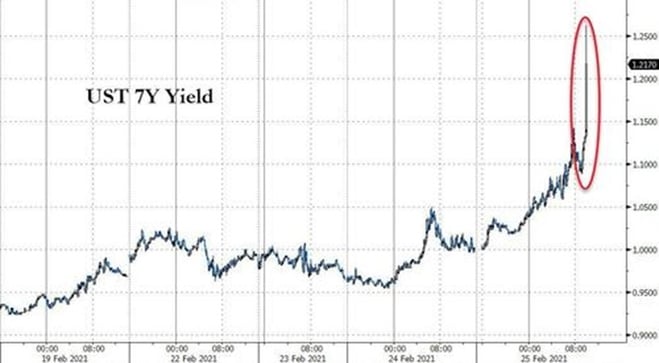

All this talk of stronger economic growth, apparent official indifference to higher inflation, and continued yield suppression at the longer end of the curve was too much for skittish bond traders. (As we have explained before, these guys DO NOT LIKE strong economic growth or inflation). Last week we mentioned the return of the “bond vigilantes”; this past Thursday they were out in force, hitting bids with a vengeance and causing what can arguably be called a failed auction in the federal governments’ latest offer of seven-year treasury notes.

Zero Hedge

Zero Hedge

Yields gapped higher all along the curve, setting off alarm bells among central bankers who have long claimed, with no small degree of hubris, to have had all this under their personal control since the Panic of 2008. Response was about as expected, with the Bank of Japan and the Reserve Bank of Australia both increasing their QE purchases while the incoming governor of the Bank of Greece called on the ECB to increase its level of QE, in order to stem as rise in borrowing rates. The incoming governor claimed there is no reason for the fun-up in bond yields so the ECB should simply buy bonds to calm things down.

Left unasked is why respond to an unwarranted rise in bond yields, and with a policy (QE) that has proven largely ineffective? Such is the thinking at central banks these days.

But it was left to the uber-governor, Fed chief Jay Powell, to assuage all the jittery bond traders out there with carefully chosen words intended to soothe this unruly lot. Speaking last Friday following the rout in bond yields, he made it abundantly clear to market participants that the Fed will not be raising rates at any time in the near future, despite speculation earlier last week of just that possibility. He also repeated the Fed’s “arbitrary” three-year time frame to achieve an average inflation rate of 2.0% with “maximum” employment. Coupled with continuing (and unchanged) QE, this may be sufficient to calm Mr. Market (at least for now).

***

FinViz

Just before the sell-off in the bond market, CAD hit its highest level in three years, briefly trading through the 1.2500 level (80 cents US) before falling back.

As we pointed out last week, the near-term outlook for the loonie, and the Canadian economy, is murky at best. The roll-out of the CV-19 vaccine continues at a snail’s-pace, with the country’s largest province, Ontario, promising to have an online appointment website operational by March 15th.

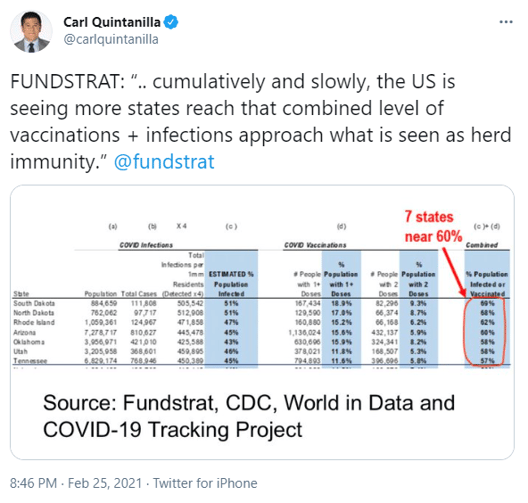

Again, as we have pointed out previously, delays in vaccinating the citizenry will have a negative impact on government deficits, central bank policy options, and dates anticipated for re-opening the Canadian economy. Clearly, none of this is even remotely conducive to bolstering consumer confidence. Contrast all this with the brisk pace of vaccinating in America and the fact that several states are nearing herd immunity:

As we pointed out last week, any strength in the loonie is a reaction to greenback weakness while the domestic economy remains under a cloud.

***

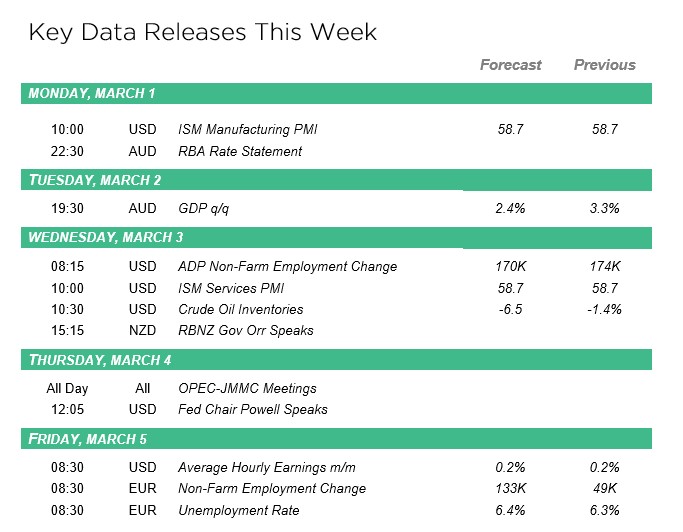

This week sees the all-important labour market statistics in the US, a mix of other metrics and a dash of Fedspeak.

|

by David B. Granner Senior FX Dealer, Global Treasury Solutions |

|||

Would you like to receive all of our blog posts directly to your inbox? Click here to subscribe!