Last Rites

It was supposed to be a quiet week but thanks to “the Donald” it was not to be. Donald Trump has been President for 30 weeks – he has had more than a few disastrous weeks but this past one was, by far, his worst week. Rather than forcefully condemn the violence and racism of neo-Nazis in the Charlottesville violence, during which a white supremacist rammed his car into a group of counterdemonstrators, killing one person and injuring roughly 20 more, Trump blamed "many sides" for the violence. The following day, at a press conference that was supposed to focus on infrastructure, Trump added to his faux pas, by claiming that the "alt-left" was at least partially responsible for the violence as well and wondering whether the counterdemonstrators have any "semblance of guilt." By placing right-wing radicals and their opponents on the same moral plane, Trump successfully transformed the Charlottesville catastrophe into a political scandal causing business CEOs to resign from the PResident's Manufacturing Jobs Initiative and the Strategic and Policy Forum council.

This latest self-induced Trump turmoil led to the second largest drop in US equities this year. But the damage doesn’t stop there, as this incident has created a leadership crisis which further isolates the President from business, military and political leaders making it much more difficult to push forward his economic agenda. Let’s face it, Trump is Trump, he’s unpredictable, and always finds a way to stick his foot into his mouth – he is incapable of changing his behaviour at this junction of his life. We think that people are coming to recognize this and for this reason, and others we will outline below, the so called “Trump trade” in the stock market and the USD may be ready for its last rites.

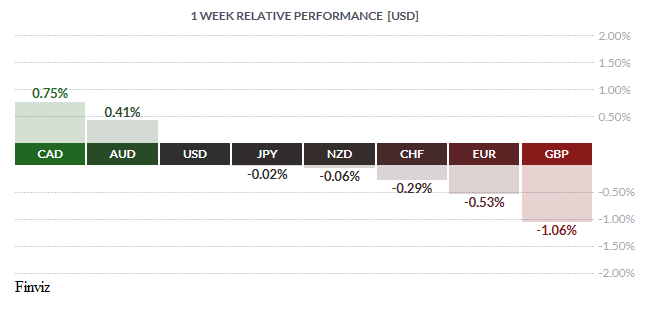

Hard to believe, but it wasn’t all about Trump last week in the currency markets. The latest inflation readings for Canada and the UK were the key driver for their respective currencies. The CAD was the clear winner on the week with a gain of 0.75% on the week. The CAD hit its strongest level since August 4th as July’s inflation report showed some signs of life last month. Annual inflation accelerated to 1.2%, in line with economist expectations, after falling to an almost two-year low of 1% the previous month. The report also showed a second straight gain in core inflation. This report has put the odds of another rate hike from the Bank of Canada, at its October meeting, at 67%. The report also caused the USD/CAD chart to record an “outside down” move (bullish for the CAD and bearish for the USD) in both the daily and weekly chart lending credence to another strong move in the CAD against the USD. If this Tuesday’s Canadian retail sales report shows that consumer demand is healthy, we could see the rate break towards the recent July low of 1.2410. After that, the next target would be the April 2015 low of 1.1920 but we don’t expect that without the help of another rate hike by the BOC.

There was talk of parity, again, in the currency market last week. No we are not talking about the USD/CAD rate or, for that matter, not the EUR/USD rate, which most market pundits were calling for last year. This year’s call for parity, which is gaining momentum, is for the EUR/GBP rate after both Morgan Stanley and HSBC downgraded their currency forecast for the currency pair. In both cases a negative view on the impact of Brexit along with the expectation that the European Central Bank will announce a tapering of bond purchases in the fall are the prime drivers of expected Sterling weakness. Last week’s softer than expected UK inflation report helped to fan the parity call. The GBP was down over 1% as the preferred measure of inflation (CPIH) was unchanged at 2.6%, while the month-over-month rate slipped 0.1%. The core rate was unchanged at 2.4%. The latest data suggests that the UK's bounce in inflation may peak before it reaches 3% - dampening any expectation of an imminent rate hike by the Bank of England and reinforces the idea that central bank is on hold.

Three other developments caught our eye last week – the Fed’s current view of assets prices, the possibility of the euro “overshooting”, and possible Jackson Hole disappointment surrounding the euro. Firstly, in the Fed’s minutes of its July meeting, it explicitly highlighted stretched equity valuations - "Since the April assessment, vulnerabilities associated with asset valuation pressures had edged up from notable to elevated, as asset prices remained high or climbed further, risk spreads narrowed, and expected and actual volatility remained muted in a range of financial markets." In plain language, this means that we have warned you about high stock prices, but prices continued to climb - and now the situation is even worse. The Fed is warning us that their balance sheet roll off, aka “quantitative tightening” that they intend to implement in the fall may cause stock prices to come down. This makes complete sense to us since we think that the Fed’s previous policy of “quantitative easing” is responsible for the current state of stretched equity valuations - so the opposite effect should translate into an equity slump. Proceed with caution; you can’t say that the Fed didn’t warn you.

Speaking of meeting minutes, the European Central Bank also released the minutes from its last policy meeting and they revealed a growing concern with the possible “overshoot” in the value of the euro – “While it was remarked that the appreciation of the euro to date could be seen in part as reflecting changes in relative fundamentals in the euro area vis-a-vis the rest of the world, concerns were expressed about the risk of the exchange-rate overshooting in the future.” We don’t want to overanalyses their concerns but we will leave you with this tidbit – the ECB is famous for warning about the high value of the euro. In 2004, it warned against “brutal” euro movements when the rate was at 1.28. Three years later, in 2007, it warned that the high value of the euro was “unwelcomed” when the rate had reached 1.49. So you see they can warn all they want, and you will get a knee jerk reaction when they do, but as long as the fundamentals are there to back up the movement then the euro will go higher.

Lastly, the euro briefly buckled last week after a report from Reuters that Mario Draghi will not make any policy shift announcement at next week’s gathering in Jackson Hole. Mr. Market has been anticipating that Mr. Draghi would provide a timeline for the start of tapering of QE. If this is true then the euro may sell off next week and that would provide the perfect opportunity for those clients that have been waiting to buy the euro. Draghi may wish to announce his change in policy thrust on home court with the backing of the new economic projections at the September 7th meeting. In any event, the USD consolidation (blue box below) in the month of August may soon draw to a close and restart its downturn with the help of a maligned White House and the announcement of a policy convergence by the ECB.

Key Data Releases This Week

| Forecast | Previous | |||

| MONDAY, AUGUST 21 | ||||

| TUESDAY, AUGUST 22 | ||||

| 08:30 | CAD | Core Retail Sales m/m | 0.3% | -0.1% |

| WEDNESDAY, AUGUST 23 | ||||

| 03:00 | EUR | ECB President Draghi Speaks | ||

| 10:30 | USD | Crude Oil Inventories | -8.9M | |

| THURSDAY, AUGUST 24 | ||||

| 04:30 | GBP | Second Estimate GDP q/q | 0.3% | 0.3% |

| 08:30 | USD | Unemployment Claims | 237K | 232K |

| FRIDAY, AUGUST 25 | ||||

| 08:30 | CAD | Core Durable GOods Orders m/m | 0.4% | 0.1% |

| 12:00 | USD | Fed Chair Yellen Speaks | ||

| 15:00 | EUR | ECB President Draghi Speaks | ||

|

by TONY VALENTE Senior FX Dealer, Global Treasury Solutions |