Know When To Walk Away

Last Wednesday, the Bank of Canada raised its policy rate and signaled that a pause was in order. The BOC began its rate hiking cycle on March 2nd, 2022, with a hike of 25 bps to bring the policy rate to 0.50%. It continued to raise rates for the next seven meetings in a row until ending it this past week with a 25 bps hike to 4.5%. The BOC is the first G7 central banks to reach the end of the rate hiking cycle.

The BOC expects inflation to return to its 1%-3% control range by mid-year and 2% in 2024. BOC Governor Tiff Macklem indicated that the bank would pause its rates hikes, for now, and will remain on the sidelines as long as the economy evolves as the central bank expects. When he was asked in the post meeting presser about when the BOC would cut rates he did not push back very strongly, choosing instead to say that it was too early to discuss. Just like that, the BOC understood that it was time to walk away, just like the chorus to the Kenny Rogers song “The Gambler” - You've got to know when to hold 'em, know when to fold 'em, know when to walk away, know when to run.

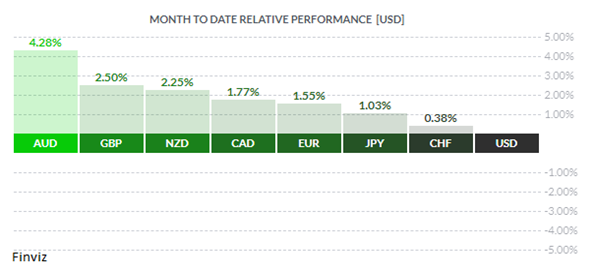

Given the somewhat dovish pause by the BOC, the CAD was rather resilient. The USDCAD rate bounced to around 1.3430 from 1.3360 before the announcement. It then proceeded to move lower after the policy announcement and the CAD managed to gain ground against the USD for the rest of the week. It finished the week up 0.52% against the USD and is up 1.77% so far this year. Having said that, it isn’t as strong as the other majors against the USD. In fact, it is the only G10 currency that has not made a golden cross (the 50-day moving average crossing above the 200-day moving average) against the USD.

The USDCAD rate had been trading between 1.3320 and 1.3520 for much of January. After the BOC announcement, it has begun to fray the lower bound of 1.3320. A clean break will open the low from November 15th at 1.3226 followed by and the 200-day moving average at around 1.32. I suspect that the market will want to see what the Fed does this Wednesday before taking it there. After that, the next level of support would be the round number psychological support level at 1.3000. In terms of resistance levels, the first resistance level is the 50-day moving average at 1.3490. Above there, the high of the January trading range around 1.3520, and then the prior highs around 1.3700.

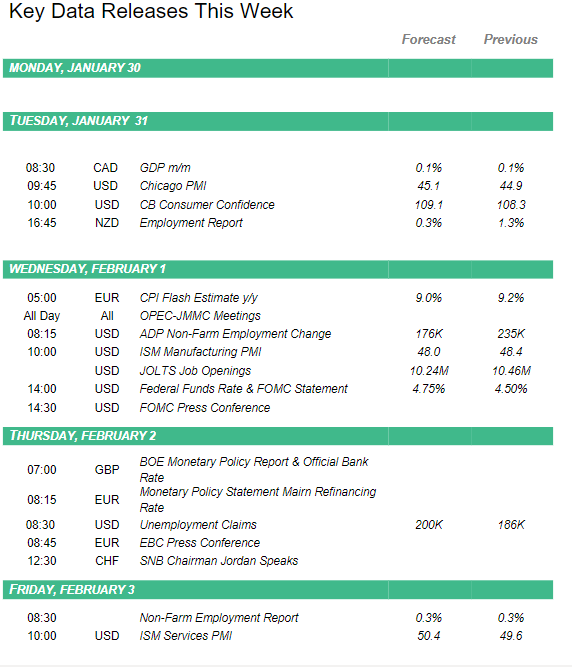

This week, the Fed, the Bank of England, and the European Central Bank will all make policy announcements. Both the BOE and the ECB are expected to raise interest rates by 50 bps. The magnitude of the hikes will be the same but the banks are at different stations of their rate hiking path. The market perceives that the BOE is 25 bps away, after this week’s move, from the so-called terminal rate. The ECB, on the other hand, is perceived to be at least another 75 bps away.

The Fed is expected to hike by 25 bps. Since “groupthink” seems to dominate 21st-century central bank thinking, the fact that the BOC was one of the first G7 banks to hike rates and is now on the sidelines has the marking thinking that the Fed will now pause. Adding to the market’s confidence, the Fed’s preferred measure of inflation, PCE core inflation, just fell to 4.4% for December from 4.7% the month prior. This certainly has made Fed Chairman Jerome Powell’s job harder – delivering a hawkish announcement.

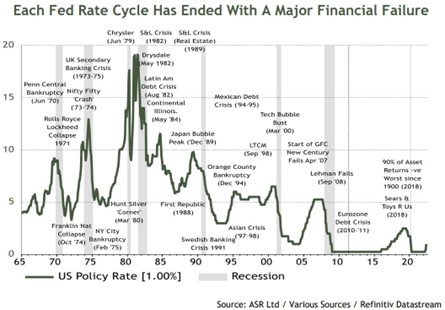

Equity market have moved up around 7% over the last quarter and are off to their best start this year since 2018. Thus, as you can see from the chart below financial conditions have eased since September. Easing financial conditions feeds into higher inflation so Powell will want to maintain his inflation-fighting credential to tamp down the bullish animal spirits. But the market keeps saying I don’t believe you. So now Powell will have to raise his hawkish stance or fold and walk away. We will find out on Wednesday.

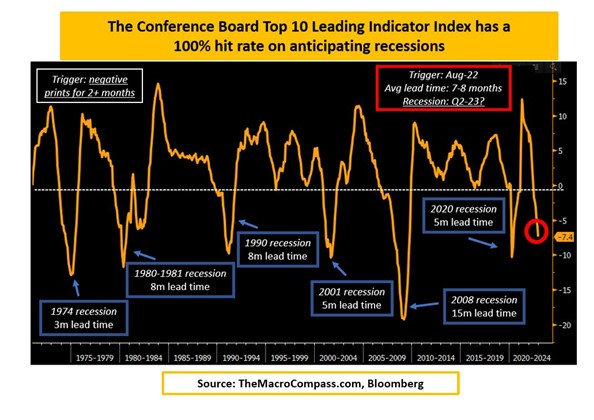

Over the last four months, the idea of a soft landing as really taken flight, hence the run up in equities. This got me thinking that the phrase “soft landing” is the new “transitory inflation” and we all know how that turned out. I will leave you with two charts that should make you question the soft landing hypothesis.

Still believe in a soft landing?

|

by Tony Valente Senior FX Dealer, Global Treasury Solutions |

|||

Would you like to receive all of our blog posts directly to your inbox? Click here to subscribe!