|

Non-Farm Employment Change

|

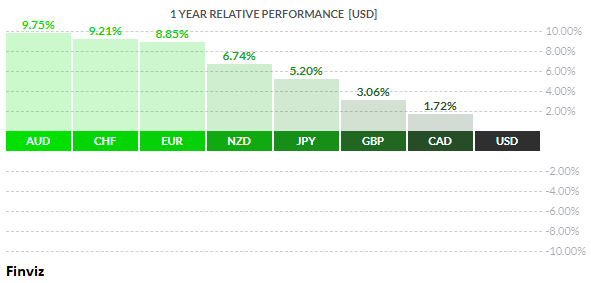

The global economy came to a sudden pandemic stop in March, which translated to a 20% hit to global GDP by the end of April. Central banks and governments went into mitigation mode and unleashed unprecedented policy easing and stimulus. This was the peak of the US dollar index and the USD resumed its downward trend that had been in place since the beginning of 2017.

Currency trends tend to play out over years, typically over roughly 7 to 10-year periods. As you can see from a month chart of the dollar index below, the index rallied from 10/1978 to 2/1985, it then fell for 7 years to 8/1982, rallied for almost 10 years to 1/2002, fell for 6 years to 3/2008, and then rallied for 8 years to 12/2016. As you can see, we are only 3 years into the cyclical down trend in the USD, which could last for another 4 to 7 years.

The bear case for the USD in general will be driven as a return of the twin-deficits. The large and growing budget deficit has been fuelled by fiscal spending due to the pandemic response and Trump’s tax cuts. A large current account deficit, which measures the flow of goods, services, and investments into and out of the country, will continue to deteriorate because the US will be unable to offer the interest rate or growth differentials that attract the world's savings.

This week Georgia's Senate runoff elections will be held, the results of which will have implications on the budget deficit. If the Democrats win both seats, that will tip the scale in their party's favor because Vice President-elect Kamala Harris would be the tie-breaking vote. It also would mean Democrats control both chambers of Congress, plus the White House after President-elect Joe Biden is inaugurated January 20th. If this scenario plays out, then the budget deficit may be a lot higher.

The title of this piece comes from the dialogue in Ernest Hemingway’s 1926 novel, The Sun Also Rises. It goes like this: “How did you go bankrupt?” Bill asked. “Two ways,” Mike said. “Gradually and then suddenly.”

This reminds me of the quandary the USD finds itself in.

No, the US is not going to go bankrupt; the Fed can print unlimited amounts of money to service the government’s debt. Of course, therein lies the dilemma. The mere fact that the Fed will keep interest rates at zero until 2023 and continue its QE program only heightens investors’ fear of debt monetization. In this scenario, the current account deficit will continue to widen as capital flees the USD for better returns elsewhere. Thus, the USD will decline gradually over time. The case for a sudden decline, which we are not expecting, would be in a hyperinflation scenario, where inflation is not caused by rising prices but rather a complete collapse in the faith of currency.

The USD has been aggressively sold off since the US election. Trade has become one-sided. Currencies don’t move in a straight line and many of the momentum indicators are stretched and warning that a counter trend rally may be in hand. This week’s Senate runoffs and the December employment data could be turning points.

Let us have a look at some of the other currencies and price chart targets for the upcoming year.

The AUD was the best performing currency last year against the USD. With the global economy expected to improve this year, the commodity currency is expected to tack on to last year’s gains. Judging by the chart, the AUD could move to the 0.8150 level which would be a nearly 6% gain for 2021.

The euro managed just over 9% against the USD last year despite a slower economy, Brexit, internal EU disputes with Poland and Hungary, Airbus-Boeing tariffs, and US sanctions on Nord Stream 2 pipeline. That’s a long list and the euro still managed a sizeable gain.

This year’s obstacles, on surface, seem less. Germany’s Angela Merkel, the driving force in the Eurozone, will be leaving this year. Her absence could potentially create a power vacuum and lead to fractures in the union. Presumably, relations with the US should improve with the Biden administration. With this in mind, the euro could move as high 1.40 level, after it clears the resistance at 1.2550. Such a large move (14.6%) seems to be a bridge too far to cross at this juncture. A 6% to 8% move seems more likely, considering the circumstances.

Even though Brexit has been negotiated there will still be some economic fallout, especially for services. The UK may have another problem on its hands: Scotland’s independence push may pick up speed in the Scottish election. These issues will engage the Bank of England to take actions which would normally be a negative for the currency. Having said that, the US’s problems may trump the UK’s challenges, thus putting a floor in the GBP. The GBP’s next target is the 1.44 level which is about 5.5% from its current level.

Japan's Prime Minister Suga and his administration have been faring well after replacing PM Abe, but Japan must hold an election by October. With politics out of the way, the rescheduled Summer Olympics are on the forefront. In this Covid environment, the Olympics will probably move from a positive economic outcome to a cost. Despite this, just like other currencies, the weight on the USD is a far greater factor than domestic Japanese concerns. The yen should be able to move to its next target on the chart, the 99 level.

In Canada, the prospects are pointing higher. A Biden administration should see better relations with the US than with Trump. Canada’s pandemic response at the government and central bank levels have been exceptional, and certainly better than many of the G7 countries, leaving it well positioned for a transition to economic growth. This, one would think, could lead to an election call by Prime Minister Trudeau, wanting to capitalize on the prospects in front of him. The CAD has the capacity to move to the 1.22 level this year, which would equate to 5.25% move.

The first week of 2021 is jam packed with economic data releases. Investors will want to see how lockdowns and restrictions affected the economy in December, thus the PMI will be the focus. December employment data for both Canada and the US will garner its usual attention, as will the Fed’s minutes from its last policy meeting.

Happy New Year! May this be the best year of your life.

Key Data Releases This Week

| Forecast | Previous | |||

| MONDAY, JANUARY 4 | ||||

| 04:30 | ALL | OPEC-JMMC Meetings | ||

| 09:30 | CAD | Manufacturing PMI | 55.8 | |

| TUESDAY, JANUARY 5 | ||||

| 10:00 | USD | ISM Manufacturing PMI | 56.6 | 57.5 |

| WEDNESDAY, JANUARY 6 | ||||

| 08:30 | USD | ADP Non-Farm Employment Change | 75K | 307K |

| 08:30 | GBP |

BOE Gov Bailey Speaks

|

||

| 10:00 | USD |

FOMC Meeting Minutes

|

||

| THURSDAY, JANUARY 7 | ||||

| 08:30 | USD | Unemployment Claims | ||

| FRIDAY, JANUARY 8 | ||||

| 08:30 | CAD |

Employment Change

|

-28.5K | 62.1K |

| 08:30 | CAD |

Unemployment Rate

|

8.6% | 8.5% |

| 08:30 | USD |

Average Hourly Earnings m/m

|

0.2% | 0.3% |

| 08:30 | USD |

Non-Farm Employment Change

|

75K | 245K |

| 08:30 | USD |

Unemployment Rate

|

6.8% | 6.7% |

Click here to subscribe and receive our weekly dispatch emails directly to your inbox every Monday!

|

by TONY VALENTE Senior FX Dealer, Global Treasury Solutions |

|||