Happy New Narrative

The currency narrative has changed. Last year, only the CAD was able to eke out a gain against the USD. By the end of 2023, the story has changed, but even the above chart doesn’t give it justice. The relative performance over the last quarter gives a clearer picture.

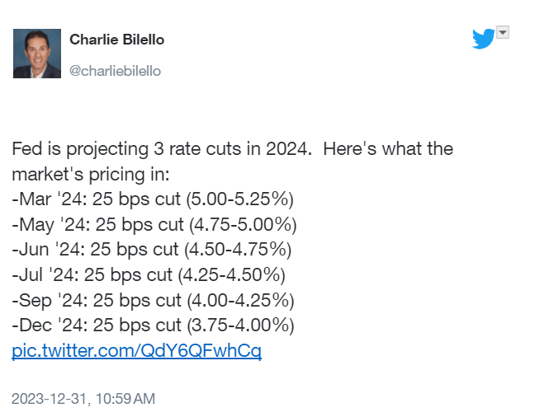

The USD has fallen out of favour. Why, because the narrative has changed around the Federal Reserve’s monetary policy stance. Most people don’t even realize that the Fed last hiked interest rates in July, that’s 6 months ago. The narrative has changed from “higher for longer” to “cuts, cuts, cuts”.

Of course, the Fed won’t be the only central bank cutting rates in the year ahead.

- European Central Bank: -161 bps (first -25 bps in April)

- Bank of England: -141 bps (first -25 bps in May)

- Swiss National Bank: -86 bps (first -25 bps in June)

- Bank of Canada: -120 bps (first -25 bps in April)

- Reserve Bank of Australia: -53 bps (first -25 bps in June)

- Reserve Bank of New Zealand: -93 bps (first -25 bps in May)

Of course, currency valuation is a relative game, so the key question will be which central bank cuts interest rates the most, or specifically which cuts interest rates the most relative to expectations.

A dovish Fed is not the only USD bearish factor. This year is an election year and that means more government spending in order to entice voters. The US has the presidential election in November and Taiwan election is this month. There are at least 3 other countries which may have elections if their current leaders feel they can win a majority (UK and Japan) and one coalition government may not last the year (Germany).

Having said that, none of these government will out spend the US government in absolute terms or on a per-capita basis which only adds to USD bearishness. The US Treasury is going to be increasingly challenged to place Treasury paper as the US deficit continues to come in at about $2 trillion a year. Meanwhile, the national debt is well over $30 trillion, and a substantial chunk of that total has to be rolled over in the next year. I think that this is what gold’s recent uptrend is all about. The price action in gold is telling us that it expects that the Fed will have to turn on the printing presses and buy the debt.

When you add in the ongoing geopolitical concerns Ukraine War, Middle East, and China Tiawan, I suspect the best currency to be exposed to is not a fiat country currency but rather the “fiat alternatives” or “store of value” plays of bitcoin and gold.