Farewell Janet

The seven week decline in the US dollar index has finally come to an end. It took a tweaking of the inflation outlook in last Wednesday’s FOMC statement, a strong US jobs report, and a sharp rise in 10-year Treasury yields to finally do it. Two weeks ago, with the index at 90.37, we pointed out that it could fall to the first level of support at 88.40 – we were close, it hid 88.25 before bounce higher. The last time the dollar index declined on a multi-consecutive weekly basis was in at the end of 2016 and the beginning of 2017. In that time span, the index fell for 6 straight weeks and then managed a shallow rally for 4 short weeks before resuming its decline for the balance of the year. Will this pattern repeat itself, or has the decline in the USD finally ended?

In order to answer this question, let’s look to see if anything has changed. Wednesday’s FOMC, Janet Yellen’s last one has the chair, was played up as hawkish by the media, however the only change in the statement that we could see revolved around inflation. The previous wording about inflation remaining somewhat below 2% in the near term was replaced with - "Inflation on a 12 month basis is expected to move up this year". That, in itself, would signal that more interest rates hikes would be warranted. However, the rest of the statement didn't offer any strong hints about any future change in the path of hikes and didn’t alter their guidance for “gradual increases”. We don’t see this as hawkish at all.

Friday’s non-farm payrolls report showed job growth rising to 200K in January, with an upward revision in December payrolls. The unemployment rate remained at 4.1% and wages grew by 0.3%. This report was solid, especially after the disappointment in December’s report, but it wasn’t enough to move the needle – it just confirms the expectation that the Fed will raise rates 3 times this year.

Rising bond yields are usually seen as very supportive to a currency. US bond yields rose again last week on the back of the FOMC statement and the solid jobs report. However, this time around, rising US yields have failed to attract flows to the USD – why is this? The short answer, is that yields have been rising in other countries as well, which has helped to negate the flows into the dollar. You see, the Fed isn’t the only game in town anymore – other central banks have begun or have signaled a move to policy normalization. This can take the form of reducing or ending monetary stimulus and increasing interest rates. In other words, the driver of USD strength since 2014 - monetary divergence, is now converging.

The convergence driver is very evident in the price action of the euro. The ECB continues to have a negative interest rate of 0.40%, a bond purchase program (QE) until September, and an extremely dovish forward guidance about rates. However, Mr. Market doesn’t buy the central bank’s rhetoric. Mr. Market strongly believes that the ECB will normalise rates quite quickly. The fact that the Eurozone is undergoing a broadening recovery has caused a very large upward adjustment to GDP forecasts in the Eurozone, which has convinced Mr. Market that the ECB will normalise rates sooner rather than later.

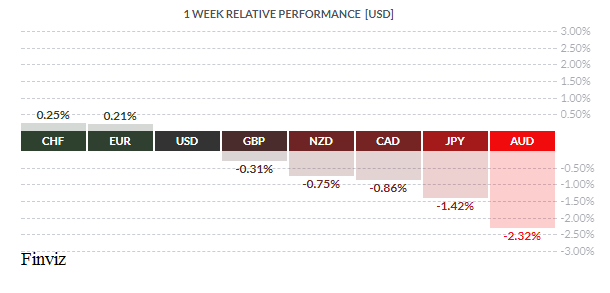

As you can see from the weekly chart of the euro, it continues to be one of the best performing currencies. Not even the latest FOMC statement or US jobs report was able to knock it back as it finished up 0.21% on the week against the dollar.

Now getting back to the question of the USD – has the downturn ended or is it just a pause? We turn to the chart for this; at this moment it would take an immediate rally through the top blue downward slopping line of 92.50 to reverse the downtrend. The momentum indicator, MACD, looks to be curling up but has not yet crossed over. Since the euro has the largest weighting in the US dollar index at 57.6%, and it is showing great resilience – it doesn’t bode well for a turnaround in the dollar index. Also, President Trump’s America First approach to trade policy ensures that the dollar will finish last. Remember, Trump has on many occasions commented on the fact that the USD was too high and that he preferred a lower dollar. Furthermore, at a press conference at the World Economic Forum in Davos a couple of weeks ago, US Treasury Secretary Mnuchin welcomed a weaker dollar, saying that it would benefit the country. A day later, when he was pressed to clarify his comments he said: “I thought it was actually balanced and consistent with what I’ve said before, which is, we are not concerned with where the dollar is in the short term.” And there it is, the administration believes in a “strong dollar” policy in the long term but in the short term, during the Presidency of Donald Trump and his “America First” agenda, the dollar will be sacrificed in the short term.

This week, the economic calendar is light and the main focus will shift away from the US. Three central bank meetings will be front and centre – the Reserve Bank of Australia, the Reserve Bank of New Zealand, and the Bank of England.

Key Data Releases This Week

| Forecast | Previous | |||

| MONDAY, FEBRUARY 5 | ||||

| 04:30 | GBP | Services PMI | 54.1 | 54.2 |

| 10:00 | USD | ISM Non-Manufacturing PMI | 56.5 | 55.9 |

| 11:00 | EUR | ECB President Draghi Speaks | ||

| 19:30 | AUD | Retail Sales m/m | -0.2% | 1.2% |

| 19:30 | AUD | Trade Balance | 0.25B | -0.63B |

| 22:30 | AUD | Cash Rate | 1.50% | 1.50% |

| 22:30 | AUD | RBA Rate Statement | ||

| TUESDAY, FEBRUARY 6 | ||||

| 08:30 | CAD | Trade Balance | -2.3B | -2.5B |

| 16:45 | NZD | Employment Change q/q | 0.4% | 2.2% |

| 16:45 | NZD | Unemployment Rate | 4.7% | 4.6% |

| WEDNESDAY, FEBRUARY 7 | ||||

| 10:30 | USD | Crude Oil Inventories | 6.8M | |

| 15:00 | NZD | Official Cash Rate | 1.75% | 1.75% |

| 15:00 | NZD | RBNZ Monetary Police Statement | ||

| 15:00 | NZD | RBNZ Rate Statement | ||

| 16:00 | NZD | RBNZ Press Conference | ||

| 19:00 | NZD | RBNZ Gov Spencer Speaks | ||

| THURSDAY, FEBRUARY 8 | ||||

| 04:00 | AUD | RBA Gov Lowe Speaks | ||

| 07:00 | GBP | BOE Inflation Report | ||

| 07:00 | GBP | MPC Official Bank Rate Votes | 0-0-9 | 0-0-9 |

| 07:00 | GBP | Monetary Policy Summary | ||

| 07:00 | GBP | Official Bank Rate | 0.50% | 0.50% |

| 19:30 | AUD | RBA Monetary Policy Statement | ||

| FRIDAY, FEBRUARY 9 | ||||

| 04:30 | GBP | Manufacturing Production m/m | 0.3% | 0.4% |

| 08:30 | CAD | Employment Change | -2.0K | 78.6K |

| 08:30 | CAD | Unemployment Rate | 5.8% | 5.7% |

|

by TONY VALENTE Senior FX Dealer, Global Treasury Solutions |