2022, The Year of the Tiger

Happy New Year! The year 2021 is finally over. This line is more sad than funny, but that’s the way it feels with covid overstaying its welcome for the last couple of years.

If you were paying attention during the past couple weeks, then forget everything that happened, nothing can be gleamed from it, its meaningless.

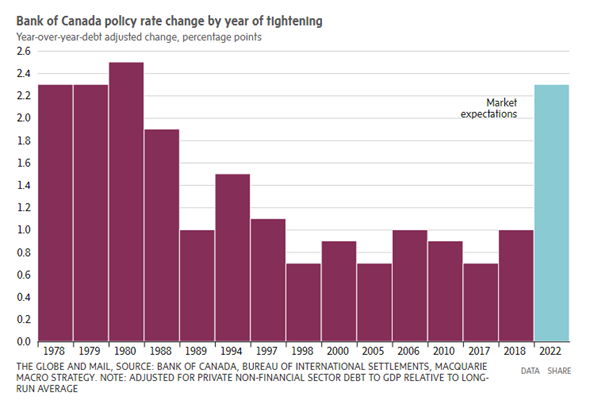

Central banks around the world, for the most part, have turned the corner and are ready to end their extreme monetary easing brought on by covid. From what I can tell, the road to monetary tightening will be a slow long winding road and not a 100-meter sprint. This is due to the amount of debt that people, companies, and governments have today compared to past cycles.

With this in mind, the futures market is pricing in two Fed rate hikes this year and around 67% of a third hike. It’s important to keep in mind that with inflation close to 7%, even if it eases back to the Fed’s 2% long-term target, that would still be a negative real rate. This environment is supportive to commodities, gold, and bitcoin.

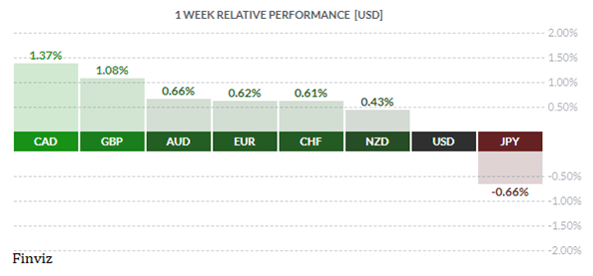

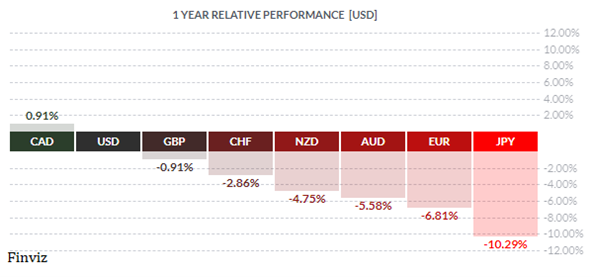

Meanwhile, the opposite is true for the outlook of interest rate hikes in Canada, which is probably the reason the CAD was the best performing currency of 2021. Currently, the market is pricing in five rate hikes by the central bank in 2022. This would be the most in a calendar year in more than two decades, this seems way too aggressive.

Meanwhile, the opposite is true for the outlook of interest rate hikes in Canada, which is probably the reason the CAD was the best performing currency of 2021. Currently, the market is pricing in five rate hikes by the central bank in 2022. This would be the most in a calendar year in more than two decades, this seems way too aggressive.

As for the other major central banks, the Bank of England, which hiked last month, is expected to hike rates 3 more times while the European Central Bank and the Bank of Japan have no plans to move rates at all from their current negative levels.

As for the other major central banks, the Bank of England, which hiked last month, is expected to hike rates 3 more times while the European Central Bank and the Bank of Japan have no plans to move rates at all from their current negative levels.

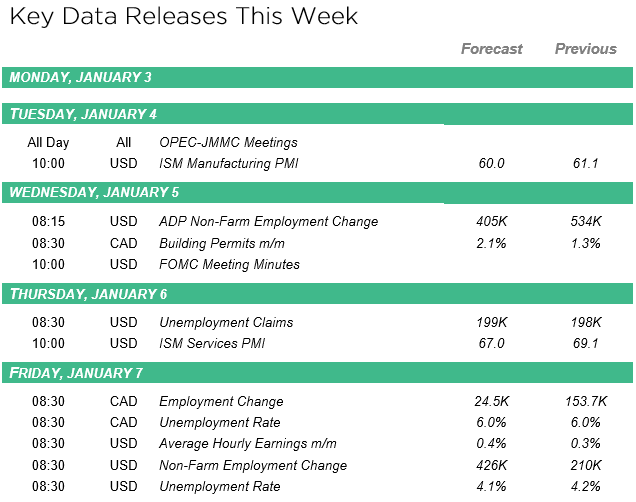

It's a brand-new year now but we're still mired by the same old issue over the past two years – inflation and the pandemic. Both issues will influence central bank policymakers. In the week ahead, the data to watch will by Eurozone inflation, global Manufacturing and Service PMIs, and payroll data for the US and Canada.

|

by Tony Valente Senior FX Dealer, Global Treasury Solutions |

|||

Would you like to receive all of our blog posts directly to your inbox? Click here to subscribe!