The Long, Long Wait

FinViz

Patience is a virtue.

(Attributed to Cato the Elder)

There is little doubt that most market participants, watching the endless talks on a proposed American stimulus package and marking time until the US federal election next week, are feeling quite virtuous these days. It’s the old army saying: hurry up and wait.

That said, there were some economic metrics of note and other such things, so let’s take a closer look, shall we?

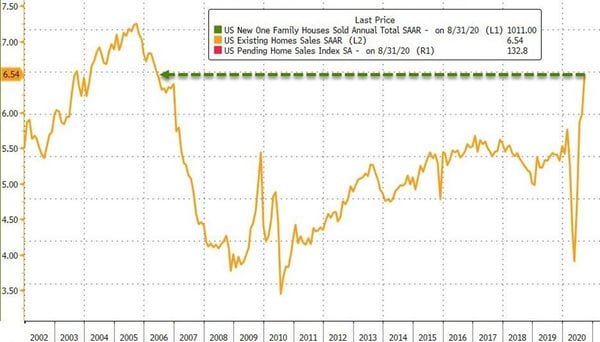

In the US, Existing Home Sales jumped +9.4% in September, almost double the street call of +5.0% and continuing a trend seen in many other western countries. Extremely low interest rates and, by extension, low mortgage rates are encouraging those who have weathered the Coronavirus pandemic reasonably well to take the plunge into home ownership. In America, sales reached levels not seen since the glory days of 2006 when anybody, it seemed, could quality for a mortgage. (As we recall, that didn’t turn out so well).

Bloomberg

Bloomberg

A +14.8% rise yr/yr in house prices along with a decline in supply to 2.7 months worth demonstrated further evidence of strength in housing.

One cannot overstate the importance of this measure. New homebuyers typically buy a lot of new stuff to furnish their new digs, so this augurs well for retail sales going forward.

Last Wednesday saw the release of the Fed Beige Book, a report on local economic activity from the various regional Fed districts. Cutting through all the usual verbiage of such reports, our learned colleagues Dr. Long and Mr. Short found this statement which largely summarised the Fed’s findings:

"Economic activity continued to increase across all Districts, with the pace of growth characterized as slight to modest in most Districts."

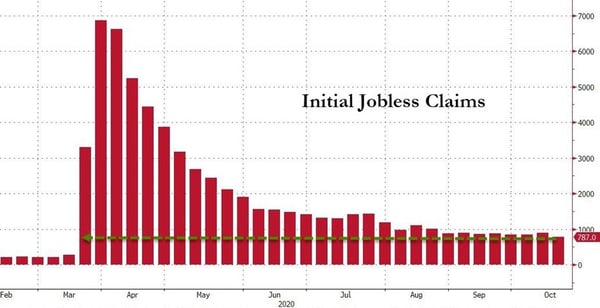

The weekly Jobless Claims report surprised to the downside. In recent weeks, the measure had been distorted by issues in the reports from the state of California. These problems have apparently been resolved, so this metric can now be viewed as reliable:

Bloomberg

Bloomberg

Analysts had called for 870K new claims, but the actual result emerged at 787K (a welcome undershooting). Continuing Claims also dropped smartly to 8.4KK, below 9.0KK for the first time since March:

Bloomberg

Bloomberg

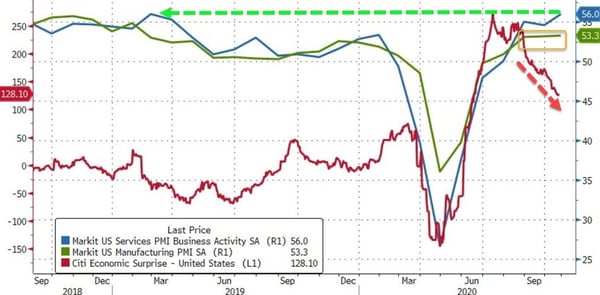

Measures of US manufacturing and services were mixed, with the Markit Manufacturing Index coming out at 53.3 vs call of 53.5, while the Services Index was stronger at 56.0 vs call of 54.6 from analysts. However, both metrics are still above the all-important 50.0 level.

Bloomberg

Bloomberg

***

During his successful 1980 election campaign against Jimmy Carter, Ronald Reagan asked voters a very simple yet devastating question:

“Are you better off today than you were four years ago?”

Many market players still remember those days well – soaring inflation, double-digit interest rates, OPEC flexing its unquestioned monopoly power, Soviet adventurism in Afghanistan and Poland and on and on – so the question was especially pertinent.

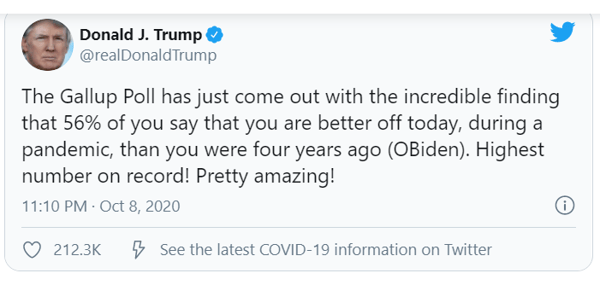

Commencing in 1984, noted pollster Gallup started asking voters this same question every presidential election year, and the results for this year are certainly interesting. To put it plainly, 56% of voters, in a survey taken in late September 2020, said they were better off under the Trump presidency than they were four years ago under the Obama/Biden administration. In other words, despite major economic dislocation and a global pandemic, over half of Americans think they are in a better position now under Donald Trump than they were under Barack Obama back in 2016. The tweeter-in-chief wasn’t about to let that pass unremarked:

Back in February 2020, before the pandemic really hit hard, this measure was at 61% expressing satisfaction with the current administration, so the decline has been marginal.

Back in February 2020, before the pandemic really hit hard, this measure was at 61% expressing satisfaction with the current administration, so the decline has been marginal.

***

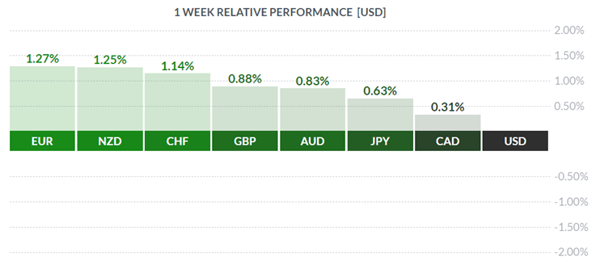

Again, we ask, what’s the takeaway in all this? The greenback was the clear loser on the week implying some sort of risk-on move by investors, although equity markets largely traded sideways while awaiting the US election.

Still, some things should be kept in mind:

- The Federal Reserve will keep rates low and credit markets liquid

- S. retail sales and home sales have been strong

- The U.S. labour market is healing

- A stimulus package is coming - perhaps not this week or next week but it is coming soon

Once the election is over and the air cleared about the result – we think the Gallup poll mentioned above is an interesting harbinger of what might happen November 3rd – then Mr. Market can roll up his sleeves and get down to the messy business of trading for a profit.

***

In Canada, there were but two economic metrics of note. Retail Sales for August disappointed with a rise of just +0.4% vs analysts’ call of +1.1% while September CPI came in as expected. The loonie traded in a tight range against the USD all week, showing only a modest gain by week’s end.

***

The coming week may prove to be interesting while we wait for the election. Canada sees a Bank of Canada rate-setting announcement on Wednesday, while America sees, among other metrics, the first read on Q3 GDP. This is expected to be a blockbuster number, with estimates in the low to mid 30%-plus area. Little in the way of Fedspeak is on tap.

Key Data Releases This Week

| Forecast | Previous | |||

| MONDAY, OCTOBER 26 | ||||

| 09:00 | USD | New Home Sales | 1025K | 1011K |

| TUESDAY, OCTOBER 27 | ||||

| 07:30 | USD | Core Durable Goods Orders m/m | 0.4% | 0.6% |

| 07:30 | USD | Durable Goods Orders m/m | 1.1% | 0.5% |

| 09:00 | USD | CB Consumer Confidence | 102.1 | 101.8 |

| 19:30 | AUD | CPI q/q | 1.5% | -1.9% |

| 19:30 | AUD |

Trimmed Mean CPI q/q

|

0.3% | -0.1% |

| WEDNESDAY, OCTOBER 28 | ||||

| 09:00 | CAD |

BOC Monetary Policy Report

|

||

| 09:00 | CAD |

BOC Rate Statement

|

||

| 09:00 | CAD |

Overnight Rate

|

0.25% | 0.25% |

| 10:15 | CAD |

BOC Press Conference

|

||

| Tentative | JPY |

BOJ Outlook Report

|

||

| Tentative | JPY |

Monetary Policy Statement

|

||

| THURSDAY, OCTOBER 29 | ||||

| Tentative | JPY |

BOJ Press Conference

|

||

| 07:30 | USD |

Advance GDP q/q

|

32.0% | -31.4% |

| 07:30 | USD |

Advance GDP Price Index q/q

|

2.9% | -1.8% |

| 07:30 | USD |

Unemployment Claims

|

787K | |

| 07:45 | EUR |

Main Refinancing Rate

|

0.00% | 0.00% |

| 07:45 | EUR |

Monetary Policy Statement

|

||

| 08:30 | EUR |

ECB Press Conference

|

||

| 09:00 | USD |

Pending Home Sales m/m

|

3.6% | 8.8% |

| FRIDAY, OCTOBER 30 | ||||

| 07:30 | CAD |

GDP m/m

|

3.0% | |

Click here to subscribe and receive our weekly dispatch emails directly to your inbox every Monday!

|

by DAVID B. GRANNER Senior FX Dealer, Global Treasury Solutions |

|||