Shakespearean Tragedy

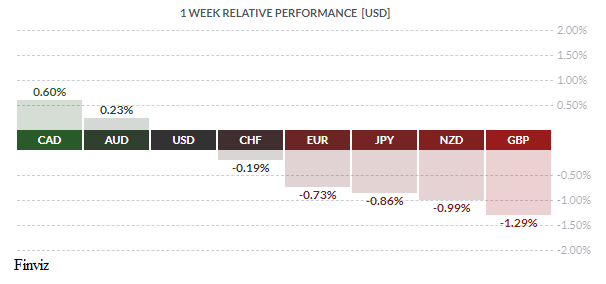

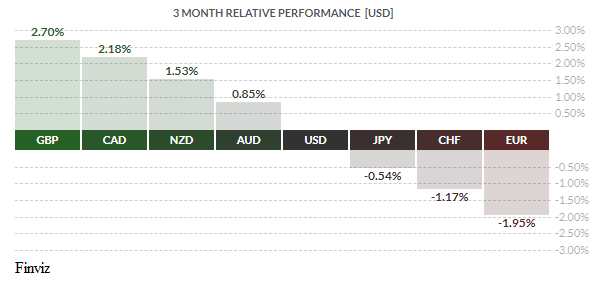

The CAD rallied hard on Friday, gaining 0.68% on the day and leading to a one-week high against the USD. Mr. Market paired back its bet for an interest rate cut by the Bank of Canada this year after data showed surprising strength for the domestic economy. The economy grew by 0.3% in January from December, better than the forecast of no growth, fully offsetting the declines of the last two months. Mr. Market has now reduced its bet from 70% to 50% for an interest rate cut by the end of the year.

The CAD rallied hard on Friday, gaining 0.68% on the day and leading to a one-week high against the USD. Mr. Market paired back its bet for an interest rate cut by the Bank of Canada this year after data showed surprising strength for the domestic economy. The economy grew by 0.3% in January from December, better than the forecast of no growth, fully offsetting the declines of the last two months. Mr. Market has now reduced its bet from 70% to 50% for an interest rate cut by the end of the year.

This stands in stark contrast to the interest outlook in New Zealand where its central bank, the Reserve Bank of New Zealand, orchestrated a big dovish turn. The RBNZ stated that its next move in interest rates was likely to be down, causing the currency to experience its biggest one day decline in 7 weeks, while helping it fall by 1% on the week. The bank said that the balance of risks to their outlook had shifted to the downside due to the continued weakening amongst their trading partners of Australia, China, and the Eurozone. It also cited that global central bank easing was putting upward pressure on the domestic currency.

Surprisingly, the GBP has been the best performing currency in Q1. However, this past week it was the worst performer, falling by 1.29% as the March 29 Brexit date has come and gone.

The champagne is on ice for what was supposed to be a celebration of UK independence from the EU. Prime Minister May’s Withdrawal Bill, which lays out the divorce agreement between the two parties, was defeated for the 3rd time in Parliament. This time around the margin of defeat was only 58 votes with 34 members of her party voting against it. As it stands now, the UK will have until April 12 to either leave without an agreement (Hard-Brexit) or seek a longer delay, which would require participation in the EU Parliament elections. Of course, May could decide to have a fourth try at passing the bill before April 12th. Betting markets see about a 15% chance of Brexit happening this year, roughly a 33% chance of a Hard-Brexit, and 50% chance of the UK remaining within the European Union through the end of 2019. Shakespeare himself couldn't have dreamed up such a hopeless tragedy as that of Brexit.

The champagne is on ice for what was supposed to be a celebration of UK independence from the EU. Prime Minister May’s Withdrawal Bill, which lays out the divorce agreement between the two parties, was defeated for the 3rd time in Parliament. This time around the margin of defeat was only 58 votes with 34 members of her party voting against it. As it stands now, the UK will have until April 12 to either leave without an agreement (Hard-Brexit) or seek a longer delay, which would require participation in the EU Parliament elections. Of course, May could decide to have a fourth try at passing the bill before April 12th. Betting markets see about a 15% chance of Brexit happening this year, roughly a 33% chance of a Hard-Brexit, and 50% chance of the UK remaining within the European Union through the end of 2019. Shakespeare himself couldn't have dreamed up such a hopeless tragedy as that of Brexit.

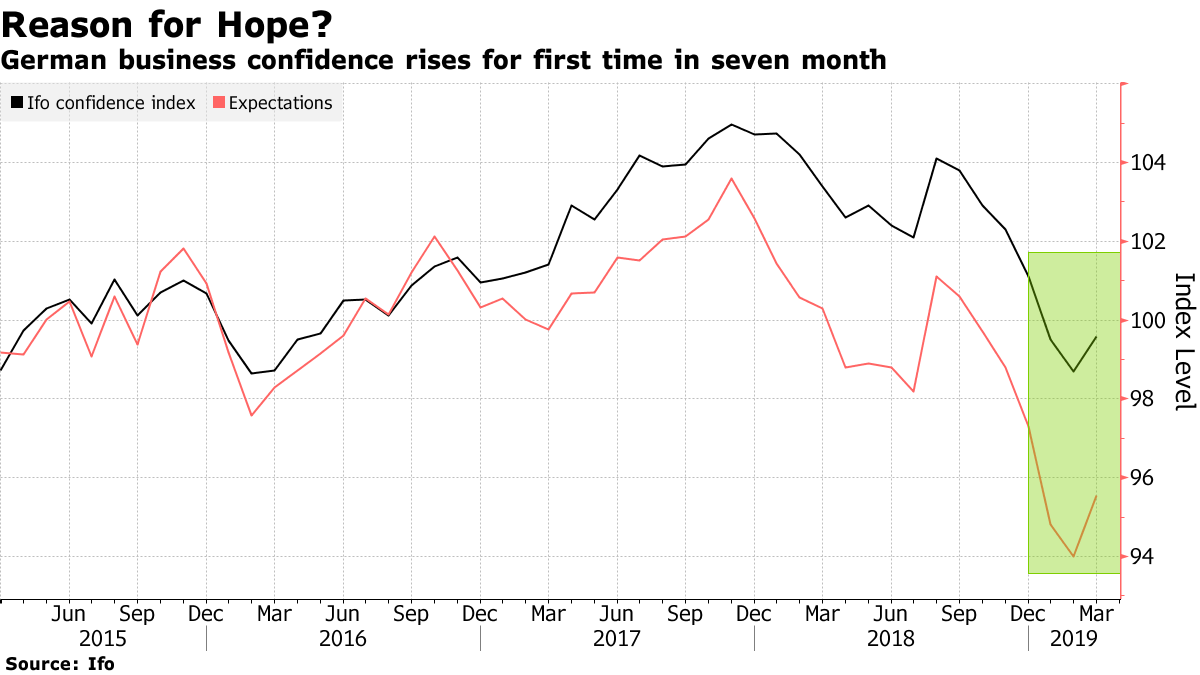

From tragedy to hope, the upside surprise in the German IFO survey has given rise that Germany’s dismal economy may be about to turn the corner. This was welcomed news from Europe’s poor flash PMI from two weeks ago. The IFO survey for March showed that the business confidence among German companies improved to 99.6 from a revised 98.7 (from 98.5). The expectations component also rose to 95.6 from a revised 94.0 (from 93.8). The overall current conditions measure was 103.8 after 103.6 (from 103.4). The increase in the sentiment measure was the first in seven months. An improving German economy, Europe’s largest, will help foster growth in the rest of the Eurozone.

Finally, a lot of ink has been spilled regarding yield curve inversion and it’s signalling of recessions. An inverted yield curve has correctly predicted nearly every recession in the past 50 years except one. Recessions started from as early as 11 months after inversion to as long as 18 months. Having said that, but no other time period prior to recessions have we had 10 years of ultra-low (emergency level) interest rates with massive QE to boot. History tells us some things but not everything. Besides, where is the surprise here? After the longest expansion ever (going on 10 years now), a recession or break from economic growth is long overdue.

Key Data Releases This Week

| Forecast | Previous | |||

| MONDAY, APRIL 1 | ||||

| 08:30 | USD | Core Retail Sales m/m | 0.4% | 1.4% |

| 08:30 | USD | Retail Sales m/m | 0.3% | 0.7% |

| 10:00 | USD | ISM Manufacturing PMI | 54.2 | |

| 14:55 | CAD | BOC Gov Poloz Speaks | ||

| 20:30 | AUD | Building Approvals m/m | -1.7% | 2.5% |

| 23:30 | AUD | RBA Rate Statement | ||

| TUESDAY, APRIL 2 | ||||

| 04:30 | AUD | Annual Budget Release | ||

| 08:30 | USD | Core Durable Goods Orders m/m | 0.3% | -0.2% |

| 20:30 | AUD | Retail Sales m/m | 0.3% | 0.1% |

| WEDNESDAY, APRIL 3 | ||||

| THURSDAY, APRIL 4 | ||||

| FRIDAY, APRIL 5 | ||||

| 08:30 | CAD | Employment Change | -10.0K | 55.9K |

| 08:30 | CAD | Unemployment Rate | 5.8% | 5.8% |

| 08:30 | USD | Average Hourly Earnings m/m | 0.2% | 0.4% |

| 08:30 | USD | Non-Farm Employment Change | 175K | 20K |

| 08:30 | USD | Unemployment Rate | 3.8% | 3.8% |

|

by TONY VALENTE Senior FX Dealer, Global Treasury Solutions |