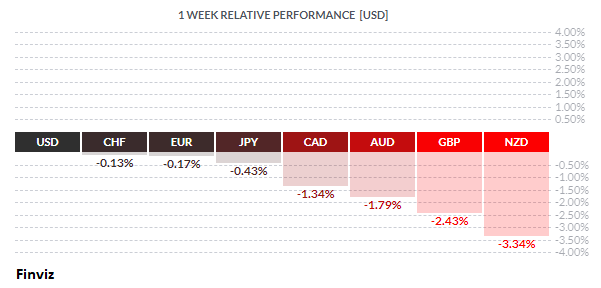

Risk sentiment was the prevailing market force last week in the currency market. It was a risk-off mood in the equity markets, which favours the USD and currencies that have negative interest rates such as the swiss franc, euro, and yen. Sentiment was soured by news that the trade war was back. China imposed restrictions on Australian beef and barley as retaliation for its support for a probe into the origin of the coronavirus. This was followed by news that President Trump directed federal pension funds to halt investments in Chinese stocks.

At the other end of the spectrum were the GBP and NZD, which were weighed down by the negative risk sentiment and country-specific news. The UK and the EU have "made very little progress towards agreement on the most significant outstanding issues between us", said the UK's Brexit negotiator David Frost. The key here is that Prime Minister Boris Johnson continues to reject any extension, which means that Brexit will be a hard one with significant economic fallout. For New Zealand, its currency was left reeling by Wednesday’s meeting of the Reserve Bank of New Zealand. The RBNZ doubled its bond-buying program and retained the optionality of utilizing negative policy rates in the future.

As I stated before, the coronavirus lockdown has made the analysis of economic data a moot point since all the data points took a severe downtown in economic activity. This is allowing us to explore other topics that we would not have a chance otherwise. One such topic is the relationship between the reserve currency status of the USD, the national debt, gold, and the reset.

Prior to Word War I most countries were on a gold standard, which meant that a country's currency was directly linked to gold. With the onset of WWI, most countries abandoned the gold standard so they could pay for the expense of war with paper money. Of course, this led to the devaluation of their currencies. Great Britain was the only country not to abandon the gold standard in order to maintain its position as the world’s reserve currency. Shortly after the end of WWI, Britain was finally forced to abandon the gold standard, which cleared the way for the US dollar to become the world’s leading reserve currency.

During WWI and WWII, the US amassed most of the world’s gold by selling weapons, supplies, and other goods to their allies for gold. This set up the USD to officially become the world’s reserve currency. In 1944, representatives from 44 allied countries met in Bretton Woods, New Hampshire, to create a new currency system to manage the supply of money that would not put any country at a disadvantage. It was decided that since the world’s currencies could not be linked to gold, they could be linked to the USD, which was backed by the world’s largest gold reserves.

The Bretton Woods Agreement allowed other central banks to maintain fixed exchange rates between their currencies and the USD. In return, the US would allow other countries to redeem their USD for gold on demand. The agreement also allowed countries to buy or sell their currency to regulate their money supply in situations where their currency became too weak or too strong relative to the USD.

With countries no longer needing to amass gold reserves, they began to accumulate USD reserves. As reserves grew, countries needed a place to store their USDs, so they began buying US Treasury securities, which they considered to be a safe store of value.

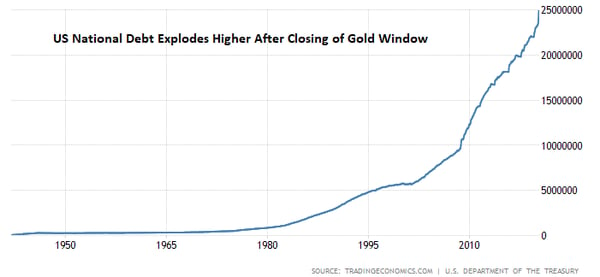

This system worked for about 20 years but by the mid-60s that changed. The US had a negative balance of payments, a growing public debt (due the Vietnam War), and monetary inflation which caused the USD to become increasingly overvalued. So, in February 1965, French President Charles de Gaulle announced his intention to exchange its USD reserves for gold at the official exchange rate. This opened the flood gates for other countries to redeem their USD reserves for gold. On August 15, 1971, President Richard Nixon officially closed the gold window in order to stop the drain of its gold reserves. This act effectively ended the Bretton Woods system and established the fiat currency system we have today. Notwithstanding, the USD remained the reserve currency of the world since oil was priced in USDs, it was the sole military power in the world, and the fact that the US had the deepest bond market in the world.

Fast forward to today, the US government has committed $2.3 trillion in COVID-19 relief spending and on Friday the House Democrats assembled a $3 trillion package for more relief. It appears to be just a matter of time before Congress passes yet another fiscal package. With all this government spending, who is going to buy all this debt? The short answer is the Fed.

The Fed will buy most of the debt which amounts to debt monetization – the financing of government operations by the central bank. The US is not alone, every country is in the same position. However, when the Fed monetizes the debt it matters because it is the reserve currency of the world. Central banks are supposed to be stewards of our money, not creators. Holders of USDs today are increasingly frustrated as they watch the Fed dilute or debase their holdings of US Treasurys by trillions.

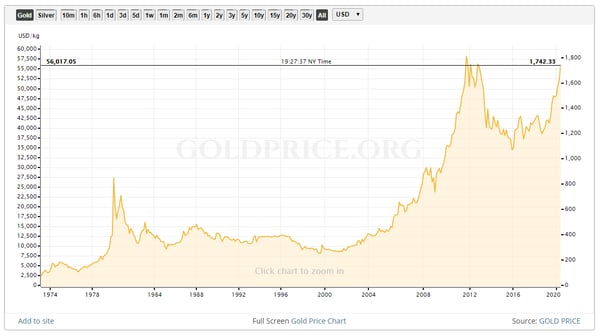

Now that you have the background, let’s turn to gold. In 1974, James Sinclair bought an ad in Barron's which said gold would go to $900 an ounce by 1980. At that time, gold was trading around $160. Gold hit an all time high of $887.50 on January 21, 1980 and on the next day, Sinclair unloaded his entire gold position, personally netting $15 million. It gets better: in 2004 gold was trading around $400, and he predicted that gold would hit $1650 by 2011. Gold went on to make a new all-time high of $1,917.90 an ounce on August 22, 2011. Do you want to know his next prediction?

Every time Sinclair is asked how he came up with his price targets, he responds by saying that during periods of monetary stress, gold will balance the international balance sheet of the US. His formula is very simple, you divide the US national debt by the number of gold ounces held in US official reserves. So, if you divide the US national debt of $25 trillion by the number of gold ounces in reserves (260,272,000) you are left with a gold price of $96,000/ounce. This is not Sinclair’s current prediction; his prediction is for $50,000 by 2025.

Now - the reset. In the 2008 financial crisis, countries absorbed more debt to solve the banking crisis. In the aftermath of that crisis, the President of France, Nicolas Sarkozy, stated that “we need a new Bretton Woods”. He thought the system was unsustainable then, but today worldwide debt has more than doubled since 2008. It took about 5 years for global economies to get back to where they were prior to the 2008 crisis. Today’s pandemic may be worse and will probably take economic activity longer to get back to pre-crisis levels. Many countries will require some sort of debt restructuring to give them fiscal capacity to support growth again.

Let’s get real: all of this debt will never be paid back, the world's financial system needs to find a different anchor. Sinclair thinks that the US, along with other countries, will reset the financial system with a new agreement like it did in 1944 with Bretton Woods. Since central banks hold gold reserves, they will agree to reset the value of gold to a level that will make national debts more manageable. This would, of course, devalue every currency and, in turn, every person’s standard of living. Sinclair thinks that the reset will fail because politicians are not “market guys”, so he thinks that the market price of gold will rise above the official reset price and hold at a new equilibrium.

Just in case you think that this is inconceivable, remember that US President Franklin D. Roosevelt presided over a reset. Roosevelt signed Executive Order 6102 on April 5, 1933 "forbidding the hoarding of gold coin, gold bullion, and gold certificates within the continental United States". The US government confiscated gold by requiring the public to sell their gold to the government at the official statutory price $20.67 per ounce. Shortly after enacting the law and acquiring all the gold held by the public, Roosevelt changed the statutory price of gold to $35 thereby devaluing the USD by 69%. Got gold?

By the way, on Friday, gold broke out of a pennant formation. Pennants are short-term triangles that form with lower highs and higher lows, over one to five weeks. Many traders look to enter new long positions following a breakout from this chart pattern.

In the week ahead, with countries around the world beginning to reopen, we may see some data improvements. The preliminary May PMI reports, Philadelphia Fed's manufacturing survey, and Germany's ZEW report may provide confirmation that economies are starting to bottom. This was the case on Friday when the New York Fed’s Empire State Survey improved from -78.2 in April to a -60.0 in May. Risk sentiment may remain negative as the battle of Trump versus China continues to rage - it is an election year, after all.

Key Data Releases This Week

| Forecast | Previous | |||

| MONDAY, MAY 18 | ||||

| TUESDAY, MAY 19 | ||||

| 01:00 | GBP | Claimant Count Change | 675.0K | 5.4K |

| All Day | All | G7 Meetings | ||

| 09:00 | USD | Fed Chair Powell Testifies | ||

| WEDNESDAY, MAY 20 | ||||

| 08:30 | GBP | BOE Gov Bailey Speaks | ||

| 21:30 | AUD | RBA Gov Lowe Speaks | ||

| THURSDAY, MAY 21 | ||||

| 02:15 | EUR | French Flash Services PMI | 28.8 | 10.2 |

| 02:30 | EUR | German Flash Manufacturing PMI | 39.0 | 34.5 |

| 02:30 | EUR | German Flash Services PMI | 26.2 | 16.2 |

| 03:30 | GBP |

Flash Services PMI

|

20.0 | 13.4 |

| 08:45 | USD | Flash Manufacturing PMI | 37.5 | 36.1 |

| 13:30 | USD | Fed Chair Powell Speaks | ||

| Tentative | JPY |

Monetary Policy Statement

|

||

| FRIDAY, MAY 22 | ||||

| 01:00 | GBP | Retail Sales m/m | -16.0% | -5.1% |

| 06:30 | EUR | ECB Monetary Policy Meeting Accounts | ||

Would you like to receive all of our blog posts directly to your inbox? Click here to subscribe!

|

by Tony Valente Senior FX Dealer, Global Treasury Solutions |

|||