EU Trade Truce

Two Fridays ago, on the eve of a G20 Finance Ministers meeting in Argentina, there was widespread fear that President Trump’s trade war was moving in the direction of a currency war. The catalyst was, by way of Twitter, a tweet accusing China and the EU of manipulating their currencies while complaining that a rising US dollar was hurting the US. This tweet caused the USD to weaken the most in four months as investors feared that the President was embarking on a new tack of jawboning the USD down to boost exports.

At the G20 meeting, US Treasury Steven Mnuchin seemed to ease concerns of any shift in currency policy, reiterating in a press conference early Saturday that America’s longstanding commitment to a strong dollar remained intact. However, in the final communique at the close of the summit, pledges made by G20 member nations in their March statement to refrain from competitive devaluations were removed from the draft statement. That statement was replaced with - We reaffirm our exchange rate commitments made in March. Play on words – maybe, but why make the change? To me, the change in wording signals that global currency war just got an official blessing.

The big showdown between President Trump and Jean-Claude Juncker, the President of the European Commission, took place on Wednesday. Perhaps Trump’s tweet about manipulating currencies was strategic – meant to force the EU in trade negotiations. If this is so, then it failed miserably. The EU obtained a trade tariffs truce from the US by offering to buy more American soybeans, liquid natural gas (LNG), and to working to eliminate tariffs on industrial goods. In exchange, the President agreed to not impose any new tariffs, especially on EU cars which Trump has repeatedly threatened, as long as trade negotiations on a free-trade agreement between the US and Europe remained in progress.

However, below the surface, these concessions by the EU weren’t particularly taxing since the EU was willing to do these anyway or was already in the process of doing them. For instance, because China was boycotting American soybeans that meant that they were buying them elsewhere, which in turn was squeezing out other buyers. This meant that those other buyers would have to switch to American farmers. The promise to buy more LNG wasn’t the actual promise – the EU actually promised to build liquefied natural gas platforms which in turn would lead to more purchases of LNG from any country. Lastly, the EU commitment of working to eliminate tariffs on industrial goods was an offer previously made to the Obama administration as part of negotiations on the now-defunct Transatlantic Trade and Investment Partnership (TTIP). As an aside, it took five years for Canada to ink a free trade deal with the EU – did the EU just buy a 5-year tariff truce.

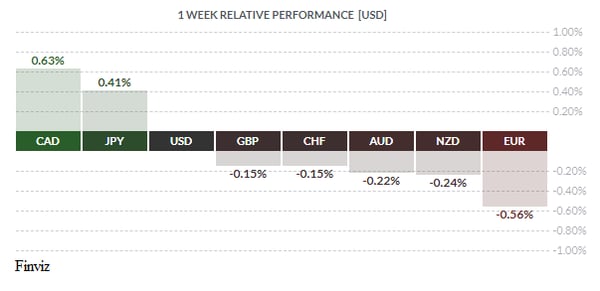

As for the currencies, the USD failed to push higher on the week despite the US posting GDP growth to a 4.1% in the second quarter, the fastest since 2014. For whatever reason the US dollar index hasn’t been able to push through the 95 level and has been turned back four times, which is a bearish sign.

As for the euro, it has traded in a mirror image of the dollar index, trapped in a 3 cent trading range between 1.15 and 1.18. The euro happened to be the worst performing currency on the week, despite Trump’s tweet, as the ECB spelled out, in no uncertain terms, that their first interest rate hike will not come until after the summer of 2019.

Next week there are central bank announcements for India, the Czech Republic, Sri Lanka, Brazil, and Mexico – but the more important announcements will be for The Federal Reserve, Bank of England, and Bank of Japan. No change in policy is expected by the Fed, especially since they just raised rates at their last meeting and are committed to gradual rate hikes. For the UK, the falling GBP could use some supporting action since it has been falling for the better part of 15 weeks. However, with risk of a hard Brexit continuing to mount, we doubt that a lone BOE rate hike will be enough to turn the tide.

The central bank which is most likely to tweak its monetary policy is the Bank of Japan. The BOJ is so deep into monetary stimulus that any tweak could be misinterpreted as a step toward normalisation which would send the yen soaring. For this reason, this meeting has the potential to be a market moving event. This is especially important considering that the USD/JPY rate is currently sitting on a potential trend line breakdown which could send the rate back to the 105 level.

For the Canadians in the room, the CAD was the best performing currency last week as the currency made a six week high. There wasn’t much market moving Canadian data last week so most of the gains were made on the notion that a breakthrough in the EU-U.S trade war would extend into some kind of agreement with Canada as well. This of course remains to be seen, especially since Trump has hinted that a deal with Mexico may come first. Trump isn’t about to forget Prime Minister Justin Trudeau’s grandstand against him at the recent G7 meeting in order to win political points at home. Because of this transgression, a trade deal with Canada no longer seems to be on the front burner. Be that as it may, the CAD looks poised to make more gains after breaking the trend line going back to mid-April and could revisit the 1.28 level.

Please note, there may be a trade truce for the EU but the trade war with China is still raging.

Key Data Releases This Week

| Forecast | Previous | ||||

| MONDAY, JULY 30 | |||||

| 21:00 |

|

ANZ Business Confidence | -39.0 | ||

| Tentative | JPY | BOJ Outlook | |||

| Tentative | JPY | BOJ Policy Rate | -0.10% | -0.10% | |

| Tentative | JPY | Monetary Policy Statement | |||

| TUESDAY, JULY 31 | |||||

| 12:30 | JPY | BOJ Press Conference | |||

| 04:30 | CAD | GDP m/m | 0.3% | 0.1% | |

| 21:30 | USD | CB Consumer Confidence | 126.5 | 126.4 | |

| NZD | Employment Change q/q | 0.4% | 0.6% | ||

| NZD | Unemployment rate | 4.4% | 4.4% | ||

| WEDNESDAY, AUGUST 1 | |||||

| 04:30 | GBP | Manufacturing PMI | 54.2 | 54.2 | |

| 08:30 | USD | ADP Non-Farm Employment Change | 186K | 177K | |

| 10:00 | USD | ISM Non-Manufacturing PMI | 59.4 | 60.2 | |

| 10:30 | USD | Crude Oil Inventories | -6.1M | ||

| 21:30 | USD | FOMC Statement | |||

| USD | Federal Funds Rate | <2.00% | <2.00% | ||

| AUD | Trade Balance | ||||

| THURSDAY, AUGUST 2 | |||||

| 04.30 | GBP | Construction PMI | 52.9 | 53.1 | |

| 07:00 | GBP | BOE Inflation Report | |||

| GBP | MPC Official Bank Rate Votes | 8-0-1 | 3-0-6 | ||

| GBP | Monetary Policy Summary | ||||

| GBP | Official Banks Rate | 0.75% | 0.50% | ||

| 07:30 | GBP | BOE Gov Carney Speaks | |||

| 21:30 | AUD | Retail Sales m/m | 0.3% | 0.4% | |

| FRIDAY, AUGUST 3 | |||||

| 04:30 | GBP | Service PMI | 54.7 | 55.1 | |

| 08:30 | CAD | Trade Balance | -2.3B | -2.8B | |

| USD | Average Hourly Rate m/m | 0.3% | 0.2% | ||

| USD | Non-Farm Employment Change | 193K | 213K | ||

| USD | Unemployment Rate | 3.9% | 4.0% | ||

| 10:00 | USD | ISM Non-Manufacturing PMI | 58.7 | 59.1 | |

|

by TONY VALENTE Senior FX Dealer, Global Treasury Solutions |