Courtesy of FinViz

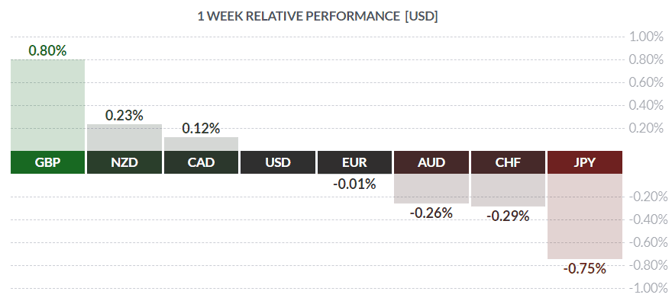

With US Thanksgiving celebrations occupying the minds of most American market players last week, it was no surprise that the FX markets traded in a relatively tight range. Equity markets saw new record highs – almost a regular occurrence – while the bond market treaded water, awaiting final confirmation of a completed Sino-US trade deal as the signal to sell. President Donald Trump said the negotiations with the Chinese were in their last ‘throes’, an odd choice of words but nothing further developed. With the absence of any hard news in the latter part of the week, and Mr. Market anticipating both turkey and football, by noontime last Wednesday the market effectively ground to a halt.

In the Great White North, the only number of note was last Friday’s release of September and Q3 GDP, rising precisely as analysts expected: +0.1% mth/mth and +1.3% annualised. The loonie sold off in response, but not too much.

CAD has been gently weakening against the greenback for several weeks now, as investors believe the Bank of Canada may look at cutting rates in early 2020. The overnight rate currently stands at 1.75%, and players are doubtful of a cut at this week’s rate-setting announcement. 2020 may be different.

In the Land of the Free, secondary economic statistics released early in the week painted a mixed picture. October Durable Goods Orders (always a difficult number to forecast) emerged at a strong +0.6% vs analysts’ call of -0.9%. Additionally, a proxy for capital investment - Capital Goods Shipments Non-Defense Ex-Air – rose a brisk +0.8% (call -0.2%). While equities rallied on this news, bonds largely shrugged it off.

Courtesy Bloomberg

US Q3 GDP saw a surprise upside revision. Investors had expected a read of +1.9%, unchanged from the previous figure. The number emerged at a strong +2.1%, cheering equity traders and helping to support the greenback.

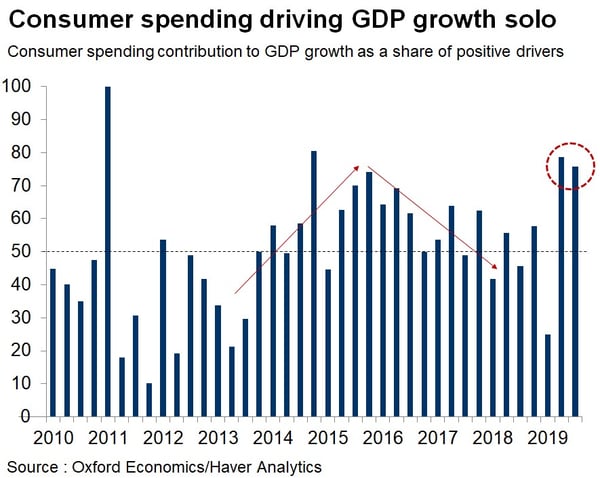

At the consumer level, however, things weren’t quite so rosy. October Personal Income was called to rise +0.3%; it came out at flat. Personal Spending was expected to rise +0.3% and it arrived spot-on. However, the yr/yr rates are declining:

Courtesy Bloomberg

Courtesy Bloomberg

The Federal Reserve’s November ‘Beige Book’ of economic activity by Fed district showed little change in outlook from the previous October report. The Fed said that economic activity did expand modestly in the reporting period. On that basis the greenback held steady during the week, besting most comers save the GBP and NZD. It does appear, though, that American consumers are doing a lot of heavy lifting:

Fun Fact: America is now running a ‘petroleum surplus’, the first since 1978 when Jimmy Carter was in the White House. The fracking outlaws are mostly responsible for this excellent state of affairs, which looks set to continue.

In the Euro Zone, all eyes were on the initial estimate of November CPI. In the event, November CPI rose +1.0% yr/yr vs call of +0.9%, while the core rate rose +1.3% yr/yr, beating the call of +1.2%. Such numbers will be welcomed by the ECB and its new head Christine Lagarde at the next rate-setting meeting. These improved inflation metrics and recent growth numbers out of zone paymaster Germany indicating a recession was avoided augurs well for the zone going forward.

In China, November PMI numbers were closely watched for signs of recovery, and investors were pleased with the results (doubtless, so was the ruling Communist Party). The CNY Manufacturing was forecast at 49.5 vs the previous month’s 49.3; it emerged at 50.2, beating the call as well as topping the all-important 50 level (PMI >50 expansion / PMI <50 contraction).

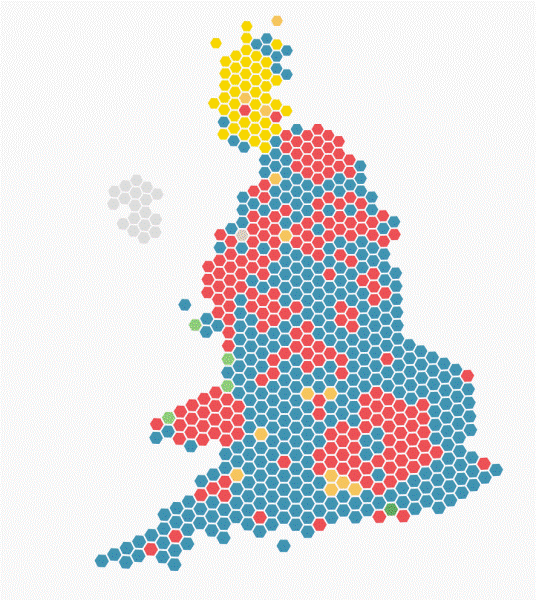

In the UK, the December 12th election is rapidly approaching. The London Times (which accurately predicted the election outcome of two years ago), has called a strong win for PM Boris Johnson, with as much as a 68-seat majority. Jeremy Corbyn and his Labour Party would be the big losers. Armed with a strong mandate, Mr. Johnson would clearly proceed with BREXIT and a major source of uncertainty plaguing the GBP could be removed. Not surprisingly, sterling ended up the winner on the week.

(Blue = Conservative // Red = Labour)

The coming week sees jobless numbers on both sides of the border, as well as a Bank of Canada rate-setting announcement. There is very little in the way of Fedspeak to watch for.

Key Data Releases This Week

|

by DAVID B. GRANNER Senior FX Dealer, Global Treasury Solutions |

|||